Israel conflict sparks temporary surge in Bitumen Prices

The recent conflict between Israel and Hamas has sent shockwaves through the global oil market, causing a significant surge in oil prices. According to a recent CNN report, oil prices experienced a 4% increase on Monday, driven by growing concerns that the weekend attack on Israel by Hamas could potentially escalate into a wider regional conflict involving oil-producing nations.

While the attack itself has not directly impacted the oil market’s supply and demand, investors are cautiously factoring in geopolitical risks. Homayoun Falakshahi, a senior oil analyst at data provider Kpler, notes that wary investors are pricing in “some geopolitical risk,” even though the impact on supply and demand remains minimal thus far.

Experts cited in a report by Times Now News suggest that the attack by the Palestinian terror group Hamas on Israel is unlikely to have a significant impact on bitumen markets and prices, as long as the conflict does not escalate further. Vandana Hari, CEO of Vanda Insights, told CNBC that there might be a temporary surge in crude prices, characterized by knee-jerk reactions.

Following the recent against Israel, there is speculation that Iran may have been involved in these attacks. However, the United States has stated that it has yet to find direct evidence linking Iran to the planning and execution of these attacks. The Biden administration has maintained that it is too early to determine whether Iran played a direct role in these events, potentially leading to further sanctions.

Current Oil Price Trends

This development follows several weeks of observing an uptrend in Brent crude oil prices, with the price briefly falling below $90 per barrel. Even the 50th meeting of OPEC+ on Wednesday, which focused on prior agreements to reduce production levels, failed to drive oil prices back above the $90 mark.

Several factors have contributed to this decline, including the strengthening of the US dollar, the possibility of a rise in interest rates, and reduced demand from traders. It appears that crude oil needs a catalyst, either in terms of increased demand or disrupted supply, to breach the $100 per barrel threshold.

Outlook from OPEC and Citigroup

Meanwhile, in an interview with BBC, the Secretary-General of OPEC stated that a significant drop in crude oil prices is not expected in the near future. He further asserted that the decision of OPEC members to continue reducing production until the end of the following year could result in a substantial shortage of oil supply in the global market, potentially pushing crude oil prices above $100 per barrel.

Conversely, Citigroup has a different outlook, predicting a bullish trend in the global market and a bearish perspective on crude oil prices. The institute estimates an average price of $82 per barrel for crude oil in the fourth quarter of this year, with an estimated price of $74 per barrel for 2024.

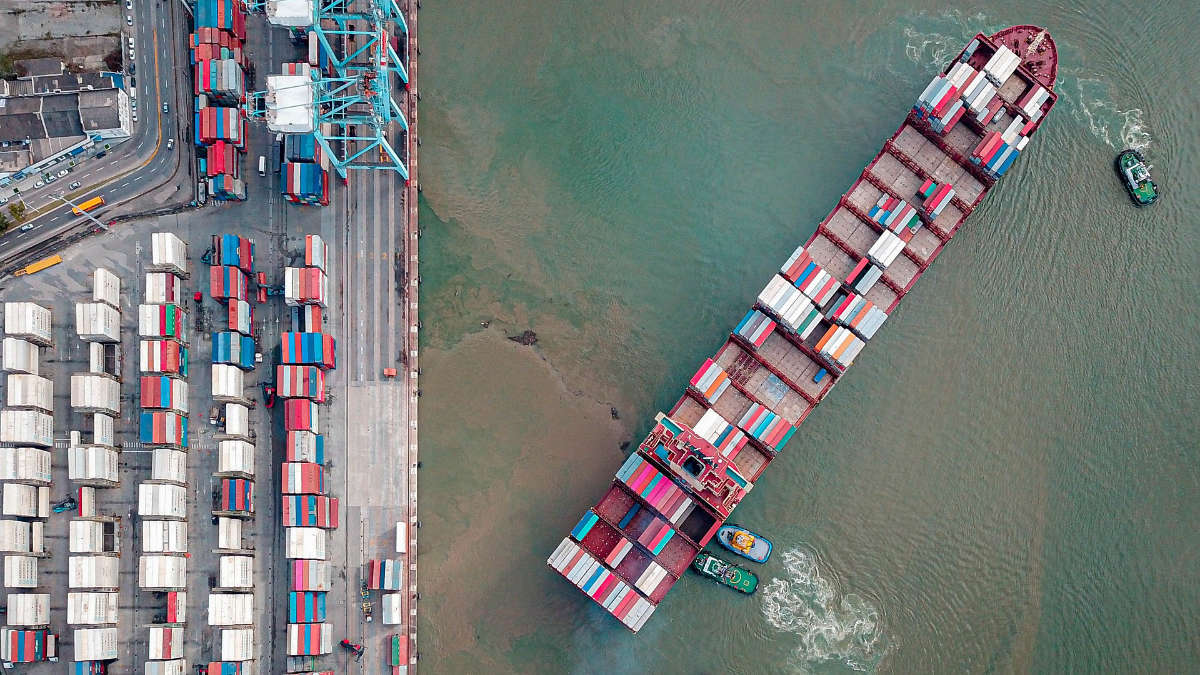

Bitumen Price Fluctuations Worldwide

In the wake of the recent drop in crude oil prices last week, Singapore’s HSFO CST180 settled at $490 per metric ton. Singapore’s bulk bitumen price exceeded fuel prices, reaching $515 per metric ton, while South Korea’s bitumen price stood at $430 per metric ton. Bitumen prices in Bahrain remained unchanged at $440 per metric ton, while European markets witnessed rates ranging from $550 to $600 per metric ton.

At the beginning of the month, the price of bitumen in India increased by $11 per metric ton, with expectations of another surge in mid-October. However, the recent fluctuations in crude oil prices have cast uncertainty over whether this anticipated rise will materialize. In Iran, bitumen prices have remained relatively stable in the short term, despite the effects of the fall in crude oil prices. There have been no significant fluctuations in prices yet.

Market Anticipation Amid Uncertainty

In light of these developments, the market is eagerly anticipating the next movements in crude oil prices to gain a clearer sense of direction in the coming days.

Investors and industry experts alike are closely monitoring geopolitical events and supply-demand dynamics, knowing that any significant shift in these factors could have a profound impact on oil and bitumen markets worldwide.