StreetLight Data raises $10m to accelerate data transformation in the Transportation Industry

StreetLight Data, Inc., the mobility analytics company that brings real-world travel patterns to light, today announced that it has closed $10 Million in Series C funding. StreetLight Data’s proprietary solution, StreetLight InSight, is an online SaaS tool designed for Smart Cities and the transportation industry.

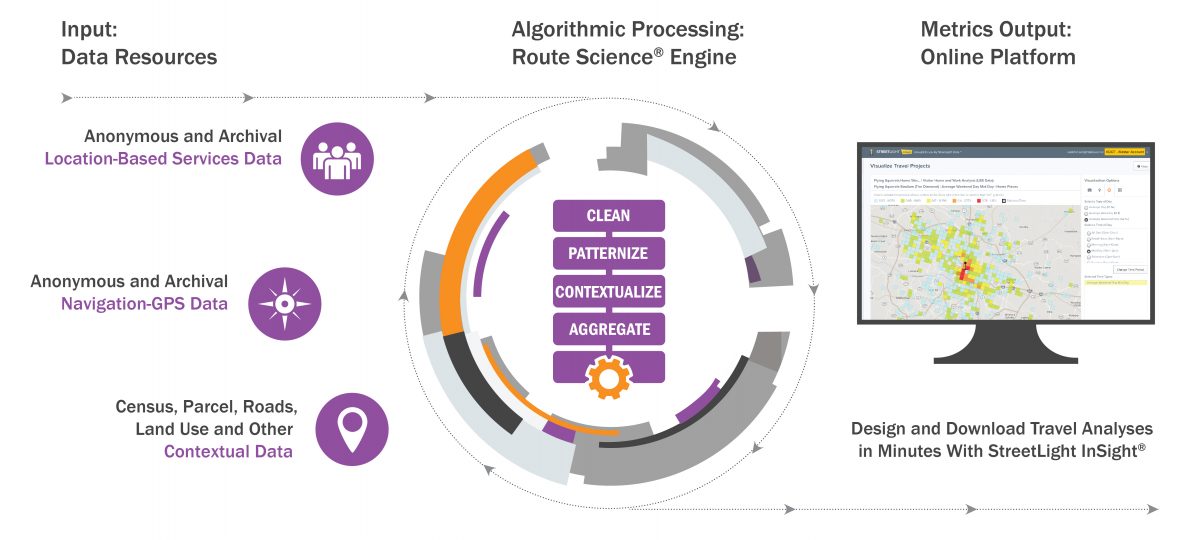

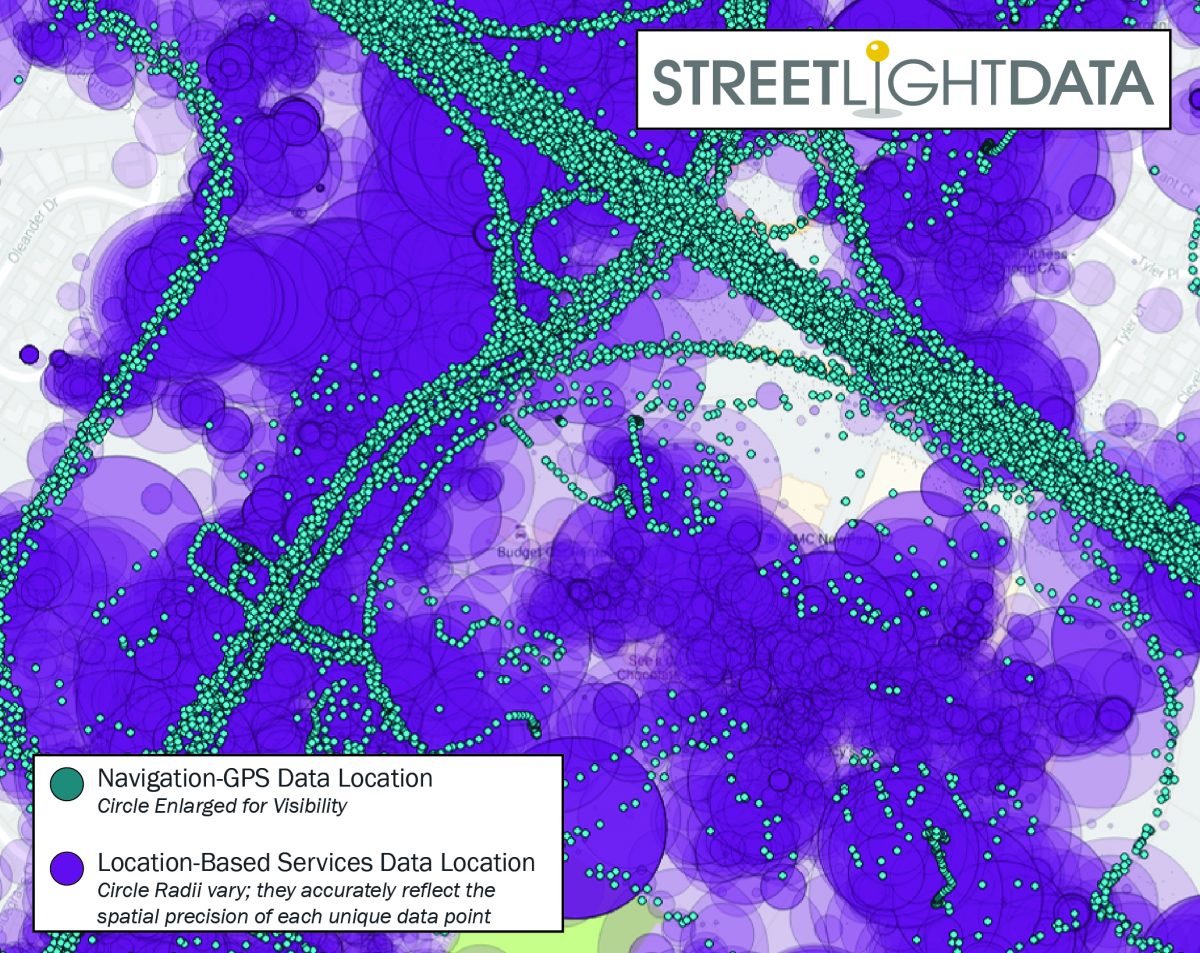

StreetLight InSight combines big data with processing and industry-targeted analytic tools that put that data to work to support critical planning, investment, infrastructure, and policy decisions. StreetLight Data aggregates and applies proprietary processing techniques to big mobile data from millions of mobile devices, connected cars and trucks, IoT sensors, and geospatial databases. The outcome is a suite of powerful analytics that analyze mobility behavior.

Since launching in 2012, StreetLight InSight has turned the hype around Smart Cities, Machine Learning, and data-driven decision making into concrete value – enabling billions of dollars of infrastructure investment to be spent in more impactful and informed ways. StreetLight Data has transformed the practice of transportation planning with hundreds of clients using StreetLight InSight including: Transportation agencies at federal, state, regional and city levels, transportation engineering and consulting firms, and private transportation companies including ride share, automaker, and IoT firms.

The Series C financing will allow StreetLight Data to invest in new product innovations that create the analytics required to tackle the biggest questions confronting transportation, including: Climate changing emissions from transportation, the impact of new modes of transportation such as ride share on communities, cost effective and resilient infrastructure investment, and how to launch autonomous vehicles in socially positive and productive ways. The financing will also accelerate the company’s targeted geographic expansion.

The oversubscribed round included significant participation from new and existing investors, including Osage University Partners, ENGIE New Ventures, DTCP (Deutsche Telekom Capital Partners), and other undisclosed investors. Veery Maxwell will be joining the board of directors in conjunction with this financing.

“We’ve seen the adoption of StreetLight InSight accelerate over the past two years. The transportation industry has turned the corner in accepting big data solutions for basic planning support,” said StreetLight Data CEO Laura Schewel. “What’s more exciting is seeing our leading clients changing their core practices due to the availability of nearly infinite analytics from StreetLight InSight. This kind of data-driven transformation is not a luxury – it’s a requirement to manage the ever-increasing complexity, risks, and rewards of our fast-changing transportation and city systems.”

“As new transportation trends converge–from car sharing, autonomous vehicles and electric cars, to the energy transformation of massive amounts of distributed renewables with variable production on the grid – the global need for data-driven infrastructure planning has become more critical than ever,” said Scott Pinnizotto, ENGIE Investment Director and StreetLight Data Board Member. “StreetLight Data is building a tool to support a sustainable approach to these rapidly evolving, ever-more interdependent systems.”

StreetLight Data is a San Francisco-based technology firm that transforms the massive amount of geospatial data produced by mobile devices into useful transportation behaviour information. Smart city leaders, transportation experts, and urban planners can access StreetLight Data’s Metrics in minutes via an easy-to-use online platform, StreetLight InSight.

ENGIE New Ventures is the corporate venture arm of global energy and service provider ENGIE. ENGIE New Ventures’ €165 million fund is focused on investments in innovative start-ups supporting ENGIE’s transformation to the decarbonized, decentralized and digitized future of energy.

Osage University Partners (OUP) is a venture capital firm focused on investing in start-ups that are commercializing pioneering university technologies. OUP partners with top research universities to invest in their most innovative start-ups, and OUP shares its investment profit with its partner institutions. The firm invests in software, hardware, and life science companies at all stages of company development. OUP has partnered with over 90 universities, including 39 of the top 50 U.S. institutions by research expenditures, and has invested in over 80 of their spinouts. OUP is part of a family of investment funds within Osage Partners, which is based in Philadelphia, PA and manages in excess of $500 million.

DTCP is an investment management group with c. $1.6 billion assets under management and advisory from Deutsche Telekom and other institutional investors, and a portfolio of over 60 companies. The group is dedicated to providing venture and growth capital, special situation investments, and advisory services to the technology, media and telecommunication sectors. It operates and invests in Europe, the US and Israel.