UK Construction Equipment sales show further growth in Q2 2018

Retail sales of construction and earthmoving equipment in the UK market grew by 3.8% in the second quarter of 2018, compared with the same period in 2017, according to the UK equipment statistics exchange. In 2017, the construction equipment statistics exchange was taken over by Systematics International Ltd., a specialist data processing company. This scheme is run in partnership with the Construction Equipment Association (CEA), the UK trade association.

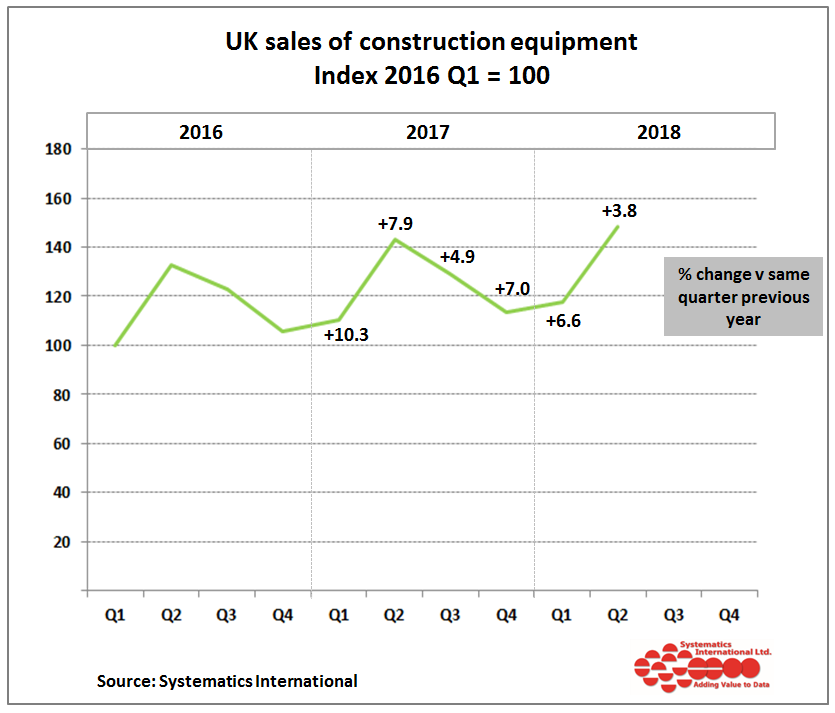

The statistics continue the trend of a slowing rate of quarterly growth this year compared with 2017, with growth last year in Q2 at just below 8%. The graph below shows quarterly sales on an index basis, using Q1 2016 as 100. This illustrates a continuing upward trend in sales, but at a slowing rate of growth. Overall, this is an encouraging position for the industry, against the background of a weak construction market, which is anticipated to show flat output, or possibly a small decline this year.

In the first half of the year, equipment sales have recorded 5% growth in total compared with the first half of 2017, reaching over 16,000 units. The graph below illustrates a consistent seasonal pattern of sales across the last 3 years, with Q2 remaining as the peak quarter of demand.

Amongst the most popular machine types, crawler excavators (over 10 tonnes) showed the strongest growth in Q2 at 11% up on the same quarter in 2017. Telehandlers and mini/midi excavators (below 10 tonnes) also continued to show growth at 10% and 3%, compared with the same quarter in 2017. The latest updates on housebuilding activity suggest growth continued in the first half of the year, and this seems to be continuing to support demand for these smaller machines. The latest feedback from the rental industry, which is estimated to account for over 60% of equipment supply, remains positive, with confidence holding amongst the major national companies.

Sales of some of the lower volume equipment types show a mix of growth rates. Wheeled loaders and backhoe loaders showed growth in Q2, but compaction rollers remain weak, and continue to show declining levels of sales compared with 2017.