Savoy Stewart reveals how a smart contract can impact property transactions

One of the biggest developments underpinned by blockchain technology has been that of smart contracts. A smart contract is essentially a computer code which can self-execute as well as self-enforce the terms and conditions laid out in a legal agreement.

Due to the decentralised nature of blockchain – a smart contract can bypass expensive ‘middlemen’ such as financial institutions and solicitors. In the commercial real estate industry, smart contracts are already being used to conduct property transactions such as buying, selling, leasing and financing.

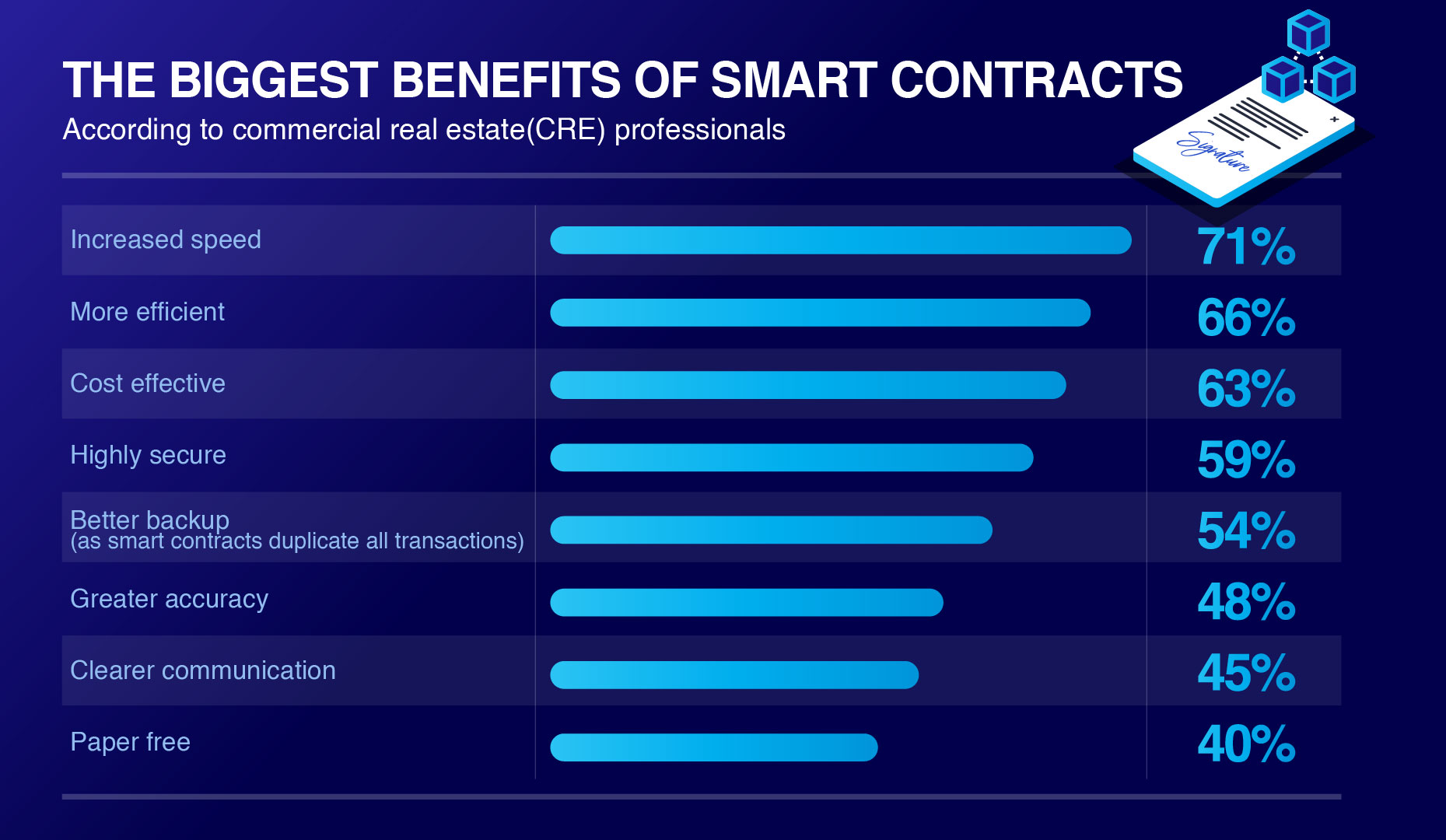

Interested in ground-breaking ‘PropTech’, commercial estate agents Savoy Stewart surveyed 544 commercial real estate (CRE) professionals to identify what they think are the biggest benefits of using smart contracts in CRE.

Savoy Stewart found 71% of professionals view increased speed as the biggest benefit of utilising smart contracts in CRE. Since smart contracts run on a software code, they don’t require documents to be processed manually. Consequently, smart contracts can significantly quicken home purchasing stages such as the processing of verification and ownership.

With CRE transactions typically involving multiple intermediaries such as brokers, banks and solicitors – a smart contract has the capabilities to take over some or all these functions. As a result, 66% of the experts believe this will enable the exchange between the buyer and seller to be more efficient.

Similarly, with fewer or no ‘middlemen’ to deal with in a smart contract, 63% of professional’s state not having to extensively splash out on expensive intermediate fees will enable both parties (buyer and seller) to save a considerable amount of money (cost effective).

Interestingly, 59% rate smarts contracts as highly secure. Rightfully so, as records on blockchain are not only permanent but cannot be altered – meaning documents cannot be forged and opportunistic property scams become almost impossible.

Opposingly, only 40% appreciate the positive impact utilising smart contracts can have on the environment as they are paper free. Slightly above, with all terms and conditions required to be recorded in explicit detail, 45% hail clearer communication as a key advantage when using smart contracts.

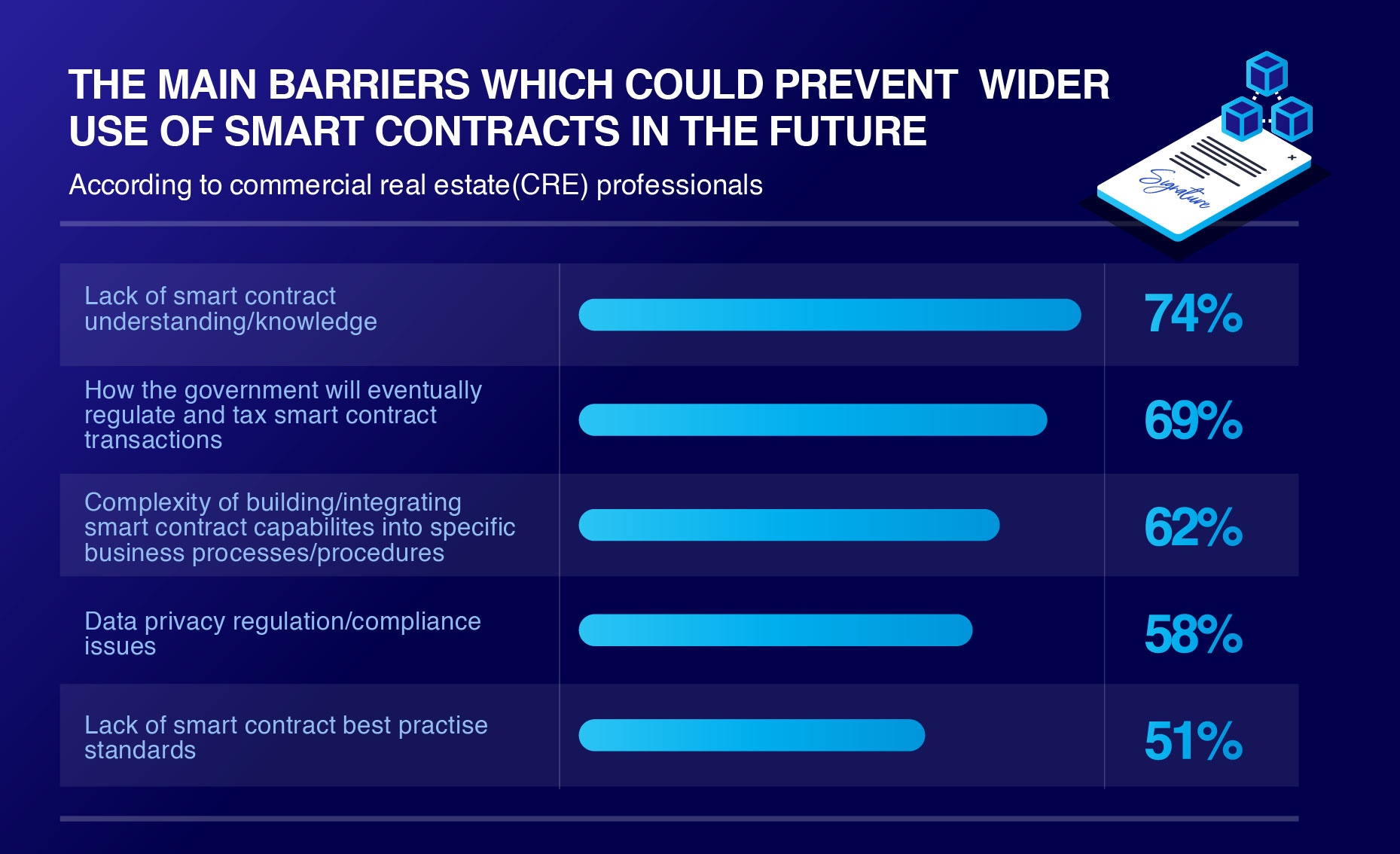

Additionally, Savoy Stewart asked the consulted professionals what they think are the main barriers which could prevent a much wider use of smart contracts in CRE going into the future.

From this, Savoy Stewart discovered that 74% of the experts place a lack of smart contract understanding/knowledge as the primary reason why the CRE industry may not use them on a greater scale going forward.

Thereafter, 69% feel until the government clearly stipulates how they intend to regulate and tax smart contract transactions – it will limit smart contract use till then.

Contrastingly, just 51% attribute a lack of best practise standards as an important factor that could negatively impact the wider use of smart contracts.

Fascinatingly, 58% think data privacy compliance might be a challenging issue – since details stored on a smart contract stays forever, it may breach certain data privacy regulations. Especially, those regulation frameworks enabling concerned parties in a contract the power to withdraw certain/particular information at request.

Darren Best, the Managing Director of Savoy Stewart commented: “Smart contracts are only in their infancy, but they have huge potential to make a real game-changing impact in the commercial real estate industry. As this research certainly shows, smart contracts have left an encouraging impression on commercial real estate professionals. The benefits highlighted by them, demonstrates the huge potential smart contracts have and as the understanding of their functionality as well as applications to different commercial real estate processes/procedures improves, they could over time gradually phase out standard paper-based contracts.”