ERA reports Europe’s equipment rental market continues to grow

The European Rental Association (ERA) has launched the ERA Market Report 2019 and reveals for the year 2018, in the EU-28 and EFTA countries, equipment rental companies and other companies providing rental services generated a total rental turnover of more than €26.0 billion.

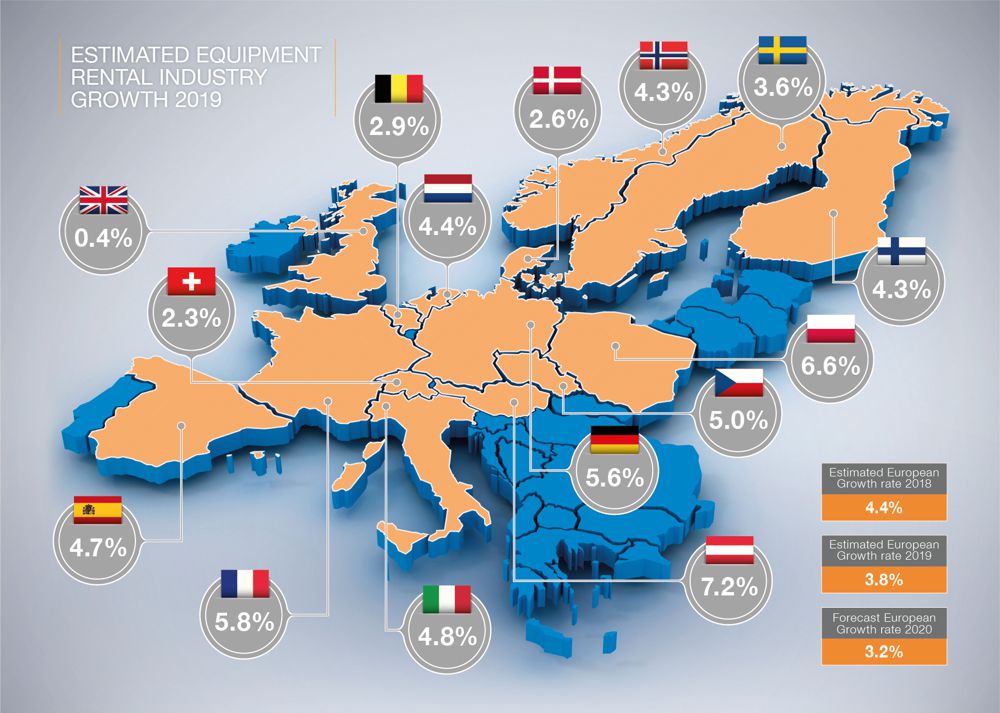

The report finds the equipment rental market has experienced growth in all 15 countries included within the research this year. Furthermore, the equipment rental industry in 2018 saw growth of 4.4%. The estimated growth for 2019 shows a 3.8% increase, and an increase of 3.2% is forecast for 2020, all at a constant exchange rate.

The rental industry of the 15 countries under investigation accounted for more than 95% of the EU-28 and EFTA countries’ total rental turnover, with the three main markets – the United Kingdom, Germany and France – accounting for 60% of the total.

Compared with the 2018 report, rental turnover has adjusted for some of the countries. In France and in Spain, the equipment rental market has been reduced/adjusted by approximatively 10%, while the market has been lifted by approximatively 10% in Switzerland due to the use of the latest official statistics.

The report is the leading source of market intelligence on the European equipment rental market and the only European-wide industry benchmark. It contains detailed market information for the years 2016 to 2021 and key indicators, including rental turnover, fleet value and investments.

The statistics provided show growth despite challenging economic circumstances. The report notes that a more confident outlook across equipment rental companies is reflected in the increase in investment in rental equipment which grew by 3.1% year on year.

As well as European-wide investment in fleet expansion and renewal, drivers for growth include an increasing recognition of the role of rental in ensuring sustainability and minimising environmental impact. According to ERA, the sustainability performance of companies can be aided by choosing to rent equipment rather than purchasing outright.

A recent report from The European Environment Agency also cites how European companies are increasingly adopting circular business models, reflecting the positive growth of equipment rental industry.

Michel Petitjean, Secretary-General of the ERA said: “The 2019 Market Report shows encouraging growth across Europe. A key driver being the increasing pressure on the industry to improve their CSR credentials, with the sustainability benefits of equipment rental being realised across industries.”

The ERA Market Report 2019 contains a country-by-country analysis of 15 European countries, detailing market size actual (2016–17) estimates (2018–19) and forecasts (2020-2021) in the local currency and key ratios including fleet size and investment (2016 – 2019). It also includes penetration rates against countries’ GDPs and construction outputs as well as an estimate, in euros, of the size of the total equipment rental market in the EU-28 and EFTA countries for 2018.

The report, commissioned by ERA, is available digitally to ERA members for €500 and to non-members for €1,200. To order a report, please contact the European Rental Association.