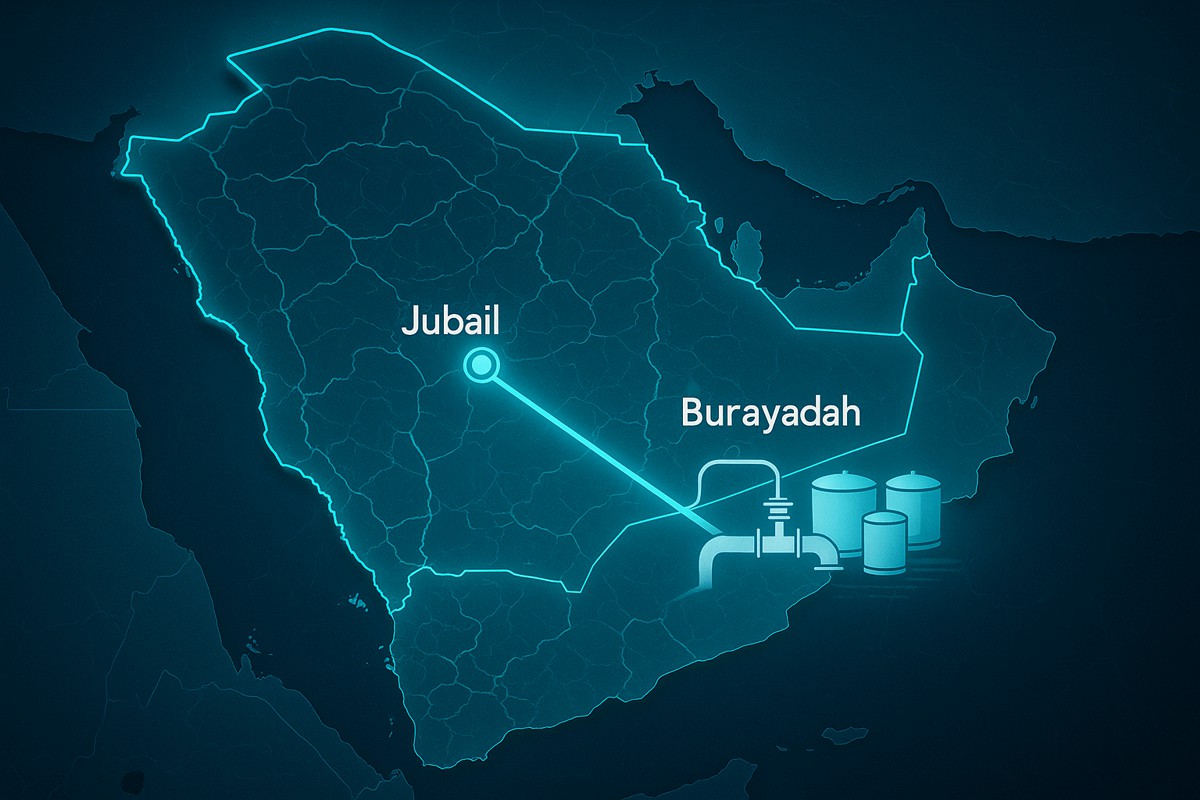

Saudi Water Transmission Network Links Saudi Regions with 587 km Pipeline

Saudi Arabia has marked a significant leap in national water security and private-sector collaboration, as the Aljomaih Energy and Water led consortium reached financial close on the Jubail-Buraydah Independent Water Transmission Pipeline Project. Valued at around SAR 8.5 billion, roughly USD 2.26 billion, the achievement strengthens the Kingdom’s fast-evolving public-private partnership model while boosting sustainable water supply across regions.

The project represents the first independent water transmission system in the Kingdom, a pivotal step toward diversifying infrastructure ownership and accelerating investment in utility networks. Underpinning this progress is a consortium of respected national developers: Aljomaih Energy and Water Company holding 45%, Buhur Investment Company with 35%, and Nesma Group taking the remaining 20%.

Crucially, the agreement follows the signing of the Water Transmission Agreement with the Saudi Water Partnership Company (SWPC), the authority tasked with structuring PPPs in the sector.

Strategic Significance and National Vision Alignment

Stretching 587 kilometres from the Eastern Province to the Qassim Region, the pipeline will move 650,000 cubic metres of desalinated water every day. A robust 1,634,500-cubic-metre storage capacity and the ability to reverse pump water offers crucial resilience to growing regional communities and industries.

Built under a Build, Own, Operate, and Transfer model, the project’s 35-year concession includes a four-year construction timeline, gearing the system for commercial operations in 2029. Once fully operational, it will deliver reliable water access to more than two million beneficiaries and operate at up to 98% availability.

The project serves as a centrepiece for the Kingdom’s National Water Strategy 2030, designed to enhance water resource security, regional connectivity, and economic resilience under the wider umbrella of Vision 2030.

Backed by Strong Islamic Financing

In a show of confidence from the region’s financial community, the project has secured support from an array of leading financiers. Backers include the National Infrastructure Fund (Infra), alongside banks such as Al Rajhi Bank, Abu Dhabi Commercial Bank, Saudi Awwal Bank, The Arab Energy Fund, First Abu Dhabi Bank, The Saudi Investment Bank, and Bank Al Jazira.

The fully Sharia-compliant structure highlights Saudi Arabia’s commitment to sustainable economic development and reinforces growing investor appetite for long-term strategic assets.

Leadership Perspectives

Mr Ibrahim Aljomaih, Chairman of the Board at Aljomaih Energy and Water Company, highlighted the project’s national impact: “The financial close of this strategic project reaffirms our commitment to supporting the Kingdom’s National Water Strategy and Vision 2030 objectives. Through this partnership, which combines local expertise with global standards, we aim to achieve long-term water security and develop a resilient infrastructure that connects the Eastern and Qassim regions. The project’s advanced storage systems and unique design will ensure a continuous supply of desalinated water, strengthening Aljomaih Energy and Water’s position as a leader in developing water and infrastructure projects across the Kingdom.”

Eng Adnan Buhuligah, Acting CEO of Aljomaih Energy and Water Company, added: “This financial close reflects the strength of our consortium and the trust our partners place in our vision. Through strategic collaboration and innovation, we are contributing to the development of high-quality water infrastructure projects in the Kingdom and building a more sustainable future. The project aims to achieve a local content contribution of no less than 45% during the construction phase and increase it to 70% during operations.”

Mr Mutlaq bin Damouk Al-Ghuwairi, Chairman of Buhur Investment, shared: “Buhur for Investment is proud to participate in this consortium alongside Aljomaih Energy and Water and Nesma Group., working jointly with the Saudi Water Partnership Company (SWPC) to develop a project that embodies the success of the public-private partnership model… fulfilling the objectives of local content and the goals of the Kingdom’s Vision 2030.”

Faisal Alturki, President of Nesma Group, noted: “This achievement demonstrates what can be accomplished when national expertise unites behind a shared goal. Nesma is proud to contribute to a project that supports Saudi vision for sustainability, resilience, and long-term prosperity.”

Expanding Local and Global Footprints

Founded in 2007, Aljomaih Energy and Water has firmly established itself as a powerhouse across utilities development, with 13 GW of power assets and a daily water production and transmission capacity nearing 1.3 million cubic metres across the Middle East and Asia.

Meanwhile, Buhur Investment, launched in 2020, has quickly emerged as a key contributor to large-scale PPP schemes, with involvement in more than SAR 23 billion worth of infrastructure projects since 2022. Nesma Group, a diversified Saudi conglomerate founded in 1979, continues to anchor major infrastructure initiatives across Saudi Arabia and beyond.

SWPC remains the backbone of the nation’s water PPP programme. With responsibility for desalination, transmission, wastewater, and storage projects, it serves as the primary off-taker for privately developed capacity, ensuring continuity, security, and resilience of water supply.

Broader Regional Context and Global Imperatives

Across the Middle East, water scarcity challenges are prompting countries to roll out capital-intensive desalination and pipeline programmes. Saudi Arabia is the world’s largest producer of desalinated water, and the Kingdom’s escalating investments signal a long-term focus on sustainability, economic diversification, and improved quality of life.

Global markets, too, are watching closely. According to the International Energy Agency, desalination capacity worldwide is set to double by 2040, with GCC countries leading deployment. International investors increasingly regard water infrastructure as a stable, high-value asset class, particularly in markets undergoing rapid urbanisation and industrialisation.

Strengthening National Resilience

Saudi Arabia’s bold infrastructure agenda continues to raise the bar for innovation, private sector participation, and long-term planning. With projects like the Jubail-Buraydah pipeline unlocking regional potential and reinforcing water independence, the Kingdom is positioning itself among the world’s most advanced water economies.

Looking ahead, such strategic investments will foster greater environmental resilience, economic growth, and social wellbeing.

Building a Smarter, Sustainable Water Future

As the Kingdom accelerates its sustainable water strategy, the Jubail-Buraydah project stands as proof that ambitious goals can be achieved through collaboration, innovation, and forward-thinking policy.

With delivery on track for 2029, the initiative reflects a brighter vision where essential infrastructure not only meets demand, but also drives national transformation.