Re-Engineering the Digital Nervous System of the Modern Vehicle

The automotive industry is no longer defined by engines and drivetrains alone. It is being reshaped, quite fundamentally, by electronics, software, and the invisible digital architectures that bind them together. At the centre of this transformation sits vehicle electrical and electronic architecture, often shortened to E/E architecture. It is not a marginal technical upgrade, but a structural rethink of how modern vehicles are designed, built, updated, and monetised over their lifecycles.

Arrow Electronics has now launched a strategic initiative and dedicated research hub aimed squarely at supporting next-generation vehicle E/E architecture. The move is less about announcing a single product and more about addressing a systemic challenge facing automotive manufacturers and tier-1 suppliers worldwide. As vehicles become software-defined platforms on wheels, the industry’s legacy approach to electronics is showing its limits.

For OEMs, investors, and policymakers alike, the significance lies in scale and consequence. E/E architecture decisions made today will influence vehicle performance, safety, cybersecurity, supply chain resilience, and upgradeability for years to come. Arrow’s initiative positions the company as a systems-level partner at a moment when the industry is struggling to reconcile complexity with speed, cost control, and regulatory pressure.

Traditional Vehicle Electronics Are No Longer Fit for Purpose

For decades, automotive electronics evolved incrementally. Each new feature, from advanced driver assistance systems to infotainment upgrades, typically arrived with its own dedicated electronic control unit. Over time, vehicles accumulated hundreds of discrete computers, kilometres of wiring, and a patchwork of software stacks that rarely spoke the same language.

That approach has reached a breaking point. Modern vehicles are expected to operate as intelligent, connected platforms, capable of receiving over-the-air updates, supporting advanced automation, and meeting increasingly strict safety and cybersecurity standards. Bolting on yet another computer for every new function is no longer sustainable, either technically or economically.

Next-generation E/E architecture represents a clean-sheet rethink. Instead of distributing intelligence across countless isolated components, computing power is consolidated into centralised or zonal hubs capable of managing multiple functions simultaneously. This architectural shift simplifies system integration, reduces duplication, and enables software to be developed, validated, and deployed far more efficiently across the vehicle lifecycle.

The practical benefits are tangible. More centralised architectures can reduce internal vehicle wiring by up to 20 percent, cutting weight and improving energy efficiency. They also make vehicles easier to update and adapt over time, a capability that is becoming commercially essential as automakers move towards subscription-based features and longer vehicle service lives.

Software-Defined Vehicles and the Rising Stakes for OEMs

The transition to software-defined vehicles is not a theoretical future trend. It is already reshaping competitive dynamics across passenger, commercial, and industrial vehicle segments. Software increasingly defines user experience, functional differentiation, and post-sale revenue potential, while hardware becomes a more standardised foundation.

This shift raises the stakes for E/E architecture design. Poor architectural decisions can lock manufacturers into inflexible platforms, inflate costs, and slow innovation. Conversely, well-designed architectures can shorten development cycles, support modular upgrades, and enable faster compliance with evolving safety and emissions regulations.

From a policy and investment perspective, the implications are equally significant. E/E architecture underpins everything from vehicle cybersecurity resilience to the scalability of autonomous driving systems. As regulators sharpen their focus on software safety, data protection, and functional reliability, OEMs must demonstrate that their underlying architectures are robust, auditable, and future-ready.

It is within this high-pressure environment that Arrow’s initiative is intended to operate, not as a technology showcase, but as an enabling framework designed to help the industry navigate a period of structural change.

Aggregating Hardware, Software and Supply Chain Capability

Arrow’s role in the global automotive ecosystem has traditionally been associated with component distribution. In this initiative, however, the company positions itself as a central solution aggregator, bridging the gap between individual components and fully integrated E/E systems.

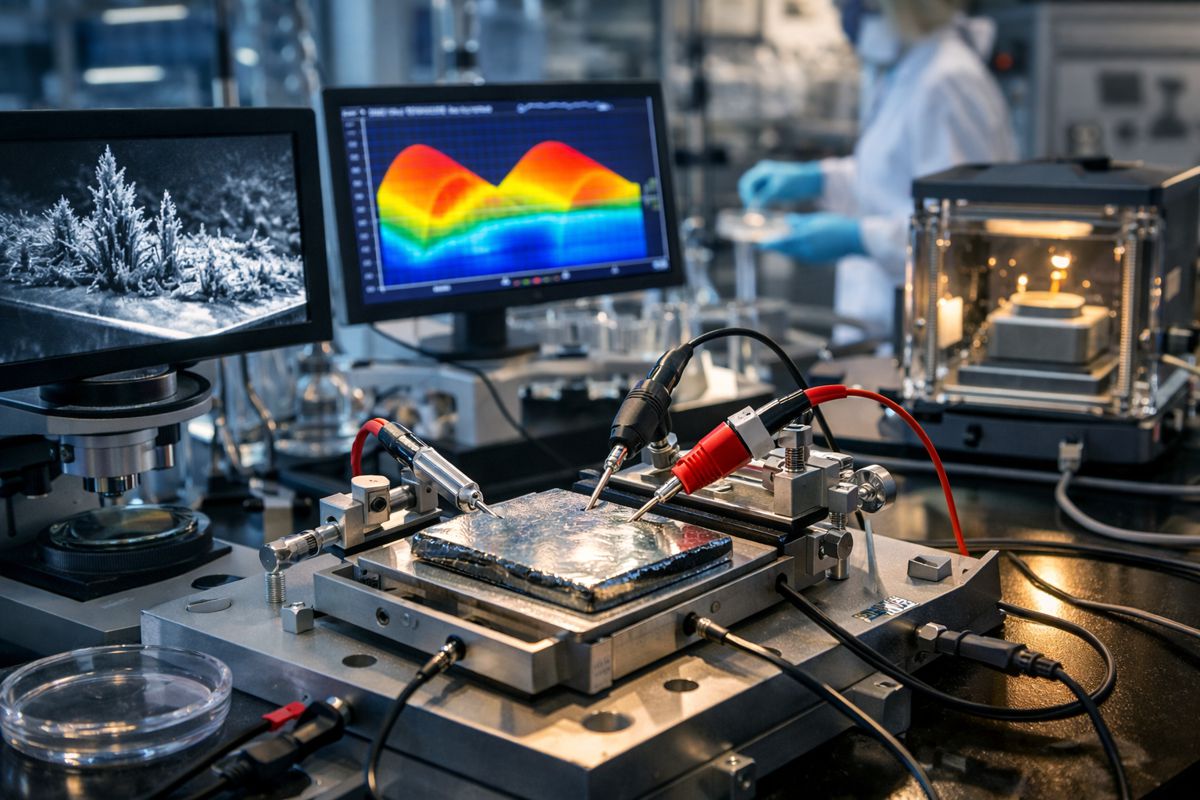

At the core of this approach is a dedicated automotive engineering capability spanning both semiconductors and IP&E components, including interconnects, passives, and electromechanical elements. This cross-technology expertise matters because E/E architecture redesign is not confined to computing power alone. It touches every layer of the vehicle’s electronic stack, from connectors and power distribution to signal integrity and thermal management.

Equally critical is Arrow’s supply chain role. The automotive industry has spent the past several years grappling with semiconductor shortages, geopolitical disruption, and the fragility of single-source strategies. By combining global inventory access with multisourced, traceable component strategies and proactive obsolescence planning, Arrow aims to reduce risk for manufacturers navigating long vehicle development cycles.

For procurement leaders, this integration of engineering insight and supply chain stability is particularly valuable. Decisions made during early architecture design phases have long-term implications for cost, availability, and regulatory compliance. Arrow’s model is designed to surface those considerations early, rather than leaving them to be resolved during production ramp-up.

Software Expertise as a Strategic Differentiator

Hardware consolidation alone does not create a software-defined vehicle. Software architecture, safety frameworks, and cybersecurity are equally decisive. Recognising this, Arrow has expanded its transportation software capabilities significantly in recent years.

The company now offers expertise in AUTOSAR environments, functional safety standards, and automotive cybersecurity, areas that have become non-negotiable for modern vehicle programmes. Functional safety requirements continue to tighten, while cybersecurity has moved from a niche concern to a board-level issue as vehicles become increasingly connected and autonomous.

This expanded software footprint reflects a broader industry reality. E/E architecture decisions must align with software development workflows, safety certification processes, and long-term maintenance strategies. By bringing these disciplines together under a single umbrella, Arrow is attempting to reduce the friction that often arises between hardware, software, and compliance teams.

The strategic intent was underlined by Arrow’s 2024 acquisitions of specialist software firms iQMine and Avelabs, both of which focus on engineering services for automotive and transportation applications. These additions strengthened Arrow’s Automotive Center of Excellence and expanded its software development capacity at a time when demand for such skills continues to outstrip supply.

Industry Context and Competitive Pressure

Arrow’s initiative does not exist in isolation. Across the global automotive sector, OEMs and suppliers are racing to modernise their E/E architectures in response to competitive pressure from both traditional rivals and new entrants. Electric vehicle specialists and technology-driven manufacturers have demonstrated how centralised computing and software-centric design can accelerate innovation cycles.

At the same time, legacy manufacturers face the challenge of evolving existing platforms without disrupting production or alienating established supplier networks. This balancing act requires partners capable of operating across generations of technology, supporting both incremental upgrades and more radical architectural shifts.

From an investor standpoint, E/E architecture maturity is increasingly viewed as a proxy for long-term competitiveness. Companies that fail to modernise risk falling behind in areas such as autonomous driving, fleet management, and digital services, all of which depend on scalable, secure electronic foundations.

Building Knowledge Through a Dedicated Research Hub

To support this transition, Arrow has launched a dedicated online research hub focused on E/E architecture development. Rather than functioning as a marketing portal, the hub is positioned as a technical resource for engineers, architects, and procurement leaders.

The platform offers technical insights, whitepapers, and design tools tailored specifically to E/E architecture challenges. By consolidating knowledge in one place, Arrow aims to shorten learning curves and provide practical guidance at a time when many organisations are still building internal expertise in this domain.

For the wider industry, such resources help demystify a topic that is often discussed in abstract terms. E/E architecture is complex by nature, cutting across disciplines and organisational silos. Access to credible, engineering-led analysis can support more informed decision-making and reduce the risk of costly redesigns later in the vehicle development process.

Navigating Complexity in a Rapidly Evolving Market

The automotive transition to software-defined mobility is not a single leap, but a series of overlapping shifts in technology, regulation, and business models. E/E architecture sits at the intersection of these forces, shaping what vehicles can do, how quickly they can evolve, and how resilient they are to disruption.

By combining engineering services, software expertise, and supply chain capabilities, Arrow is positioning itself as a partner for this next phase of automotive development. The initiative reflects an understanding that future competitiveness will depend less on isolated components and more on integrated, adaptable systems.

As Murdoch Fitzgerald, chief growth officer of global services for Arrow’s global components business, noted: “E/E architecture is the cornerstone of the modern automotive revolution, enabling the transition from hardware-centric machines to intelligent, software-defined mobility.”

For an industry under pressure to innovate faster while managing risk more carefully, the ability to re-engineer the vehicle’s digital nervous system may prove to be one of the defining challenges of the decade.