Infrastructure Africa Puts Delivery at the Centre of Africa’s Infrastructure Debate

Across Africa, infrastructure is no longer a theoretical policy ambition. It has become a hard economic requirement. Trade integration, urban growth, industrialisation and energy security all hinge on projects moving from planning documents into funded construction contracts. To address these issues Infrastructure Africa 2026 will convene public and private sector decision makers in Cape Town with a deliberately practical agenda built around financing, partnerships and execution rather than strategy papers.

Taking place alongside the Africa Energy Indaba at the Cape Town International Convention Centre on 2 to 3 March 2026, the event is structured to connect the institutions that design infrastructure policy with those who actually deliver it. Ministers, municipalities, project developers, engineering contractors, investors and development finance institutions will gather around a shared challenge. Africa has a large project pipeline, but bankable projects remain comparatively scarce.

The emphasis is clear. Infrastructure Africa is positioning itself as a working forum rather than a conference. The programme concentrates on what turns a proposal into a funded asset.

Implementation Not Just Announcements

The continent’s infrastructure deficit is well documented. The African Development Bank estimates Africa requires between 130 and 170 billion dollars annually in infrastructure investment, with a financing gap of up to 108 billion dollars each year. This gap affects transport logistics costs, electricity reliability, water availability and digital connectivity, all of which influence economic productivity and private investment decisions.

Historically, many infrastructure discussions have focused on planning frameworks and national strategies. However, investors increasingly differentiate between pipelines and procurement readiness. A project listed in a national development plan does not automatically translate into financial closure. Bankability requires risk allocation, feasibility preparation, regulatory clarity and credible off takers.

Infrastructure Africa 2026 is built around that reality. Its agenda targets the steps between concept and construction. By focusing on financing structures, procurement models and institutional cooperation, the event reflects a broader shift in infrastructure policy across emerging markets where delivery capacity now matters as much as political commitment.

Infrastructure as the Backbone of Continental Trade

One of the central themes is infrastructure’s role in enabling the African Continental Free Trade Area. AfCFTA has created a single market covering more than 1.3 billion people, yet physical connectivity remains uneven. Transport bottlenecks, port delays and border inefficiencies continue to raise trade costs across regional corridors.

Day one sessions will examine how infrastructure investment underpins regional integration. Rail freight corridors, port modernisation and cross border logistics systems are no longer just transport projects. They are trade policy instruments. Without them, tariff reductions have limited practical impact.

Industrialisation strategies depend heavily on predictable logistics. Manufacturing investors require reliable freight routes, energy supply and customs efficiency. Infrastructure development therefore acts as a multiplier. It supports trade growth, strengthens regional value chains and reduces import dependency across multiple sectors including agriculture, mining and manufacturing.

Financing Africa’s Infrastructure Pipeline

Financing models will dominate the programme. Public budgets alone cannot close the infrastructure gap, especially as many governments balance debt sustainability with development needs. As a result, blended finance, public private partnerships and institutional investment structures are becoming central to project delivery.

Sessions will examine PPP frameworks and innovative funding mechanisms aimed at attracting long term capital. Pension funds and sovereign wealth funds are increasingly considered suitable investors due to their long horizon liabilities. However, they require stable regulatory environments and predictable revenue models before committing capital.

Project preparation also plays a decisive role. Many African infrastructure proposals fail to reach financial close because feasibility studies, environmental approvals or concession structures are incomplete. The event will explore how to move projects from early stage planning into investment ready status through structured preparation facilities and advisory support.

Energy Reliability and Industrial Growth

Energy infrastructure forms a major pillar of the programme. Reliable electricity supply remains a constraint on economic expansion in several African economies. Industrial development, data centres and manufacturing growth depend on consistent grid performance and generation capacity.

Discussions will cover grid expansion, power reliability and the role of new energy systems in supporting industrialisation. Hydrogen infrastructure will also feature as countries explore export opportunities in emerging low carbon fuel markets. Ports, pipelines and renewable generation capacity will need coordinated planning to support this sector.

Energy infrastructure connects directly to economic competitiveness. Regions with stable power supply attract manufacturing and processing industries, while unreliable grids push businesses toward costly self generation. Improving energy systems therefore has both macroeconomic and microeconomic consequences.

Transport Corridors and Logistics Networks

The second day will shift into sector specific breakaway panels, beginning with transport infrastructure. Corridor development linking ports to inland economic centres remains a priority across the continent. Rail freight rehabilitation, port expansion and highway upgrades are intended to reduce logistics costs that often exceed global averages.

Efficient transport networks improve export competitiveness for commodities and manufactured goods alike. Mining operations benefit from reliable bulk transport, while agricultural producers gain access to international markets. In many cases, infrastructure determines whether natural resources can be monetised effectively.

Urban transport will also feature prominently. Rapid population growth is placing pressure on metropolitan mobility systems. Municipal governments are increasingly responsible for integrated transport planning, requiring financing tools and technical capacity previously concentrated at national level.

Cities, Water and Climate Resilience

Urbanisation is expected to add hundreds of millions of residents to African cities in coming decades. Municipalities therefore sit at the centre of infrastructure expansion, particularly in water supply, sanitation and public transport networks. The conference will address how cities can structure investment programmes and attract financing partners.

Climate resilience is another critical topic. Infrastructure built today must withstand changing rainfall patterns, extreme temperatures and coastal pressures. Water management projects and drainage systems are increasingly designed with adaptation considerations rather than historical climate assumptions.

Sustainable water infrastructure development is particularly urgent. Several regions face water stress driven by population growth and industrial demand. Long term water security depends on treatment capacity, distribution efficiency and integrated watershed management rather than isolated construction projects.

Digital Infrastructure and Smart Systems

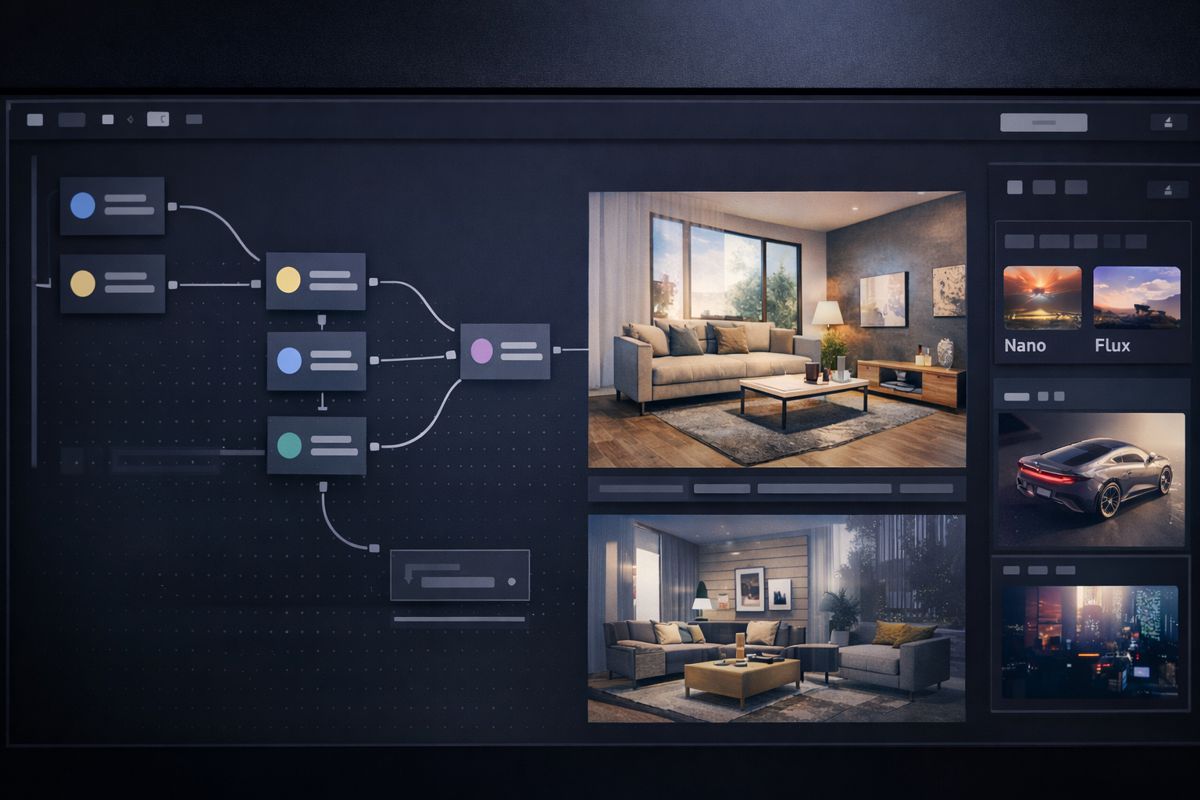

Digital connectivity has become as essential as physical infrastructure. Broadband networks, data infrastructure and artificial intelligence driven urban systems are influencing economic competitiveness and public service delivery. The programme includes sessions examining digital infrastructure investment and smart city frameworks.

Reliable connectivity supports financial inclusion, logistics tracking and industrial automation. It also enables government services to reach remote populations. Infrastructure planning increasingly combines fibre deployment with transport corridors and energy networks, creating integrated development strategies.

The inclusion of digital infrastructure discussions reflects a broader trend. Infrastructure is no longer limited to roads and bridges. It now includes data networks that underpin modern economies and support innovation sectors such as fintech and remote services.

A Platform for Public and Private Cooperation

Infrastructure development depends heavily on cooperation between governments and investors. Legal frameworks, procurement transparency and institutional capacity determine whether partnerships succeed. Infrastructure Africa positions itself as a forum where those relationships can form directly.

The attendee profile reflects that objective. Ministers, African Union representatives, municipal leaders, private funds and engineering firms share the same meeting environment. The event aims to align project sponsors with capital providers while enabling technical discussions on risk allocation and delivery methods.

Liz Hart, organiser of Infrastructure Africa, emphasised the practical intent of the gathering: “Infrastructure Africa is not about theory. It is about enabling the conversations and connections that lead to real projects being financed and implemented.”

That statement captures a broader shift in infrastructure dialogue globally. Investors are increasingly seeking credible execution environments rather than high level policy commitments. Events that facilitate negotiation and technical engagement are gaining relevance as a result.

The Broader Implications for Global Infrastructure Markets

Africa’s infrastructure expansion carries international significance. Supply chains, energy markets and manufacturing diversification are increasingly linked to the continent’s development trajectory. Improved logistics corridors affect commodity pricing and trade patterns beyond regional borders.

Engineering firms, contractors and technology providers are also watching closely. As infrastructure pipelines mature, they create demand for construction equipment, digital systems and project management expertise. Global companies view the region as a long term growth market rather than a short cycle opportunity.

Infrastructure Africa 2026 therefore sits at the intersection of policy and project delivery. By focusing on implementation and financing readiness, it reflects a maturing approach to development where the priority is not announcing infrastructure ambitions but executing them reliably.