Equipment boom in UK and Europe as buying and selling trends change

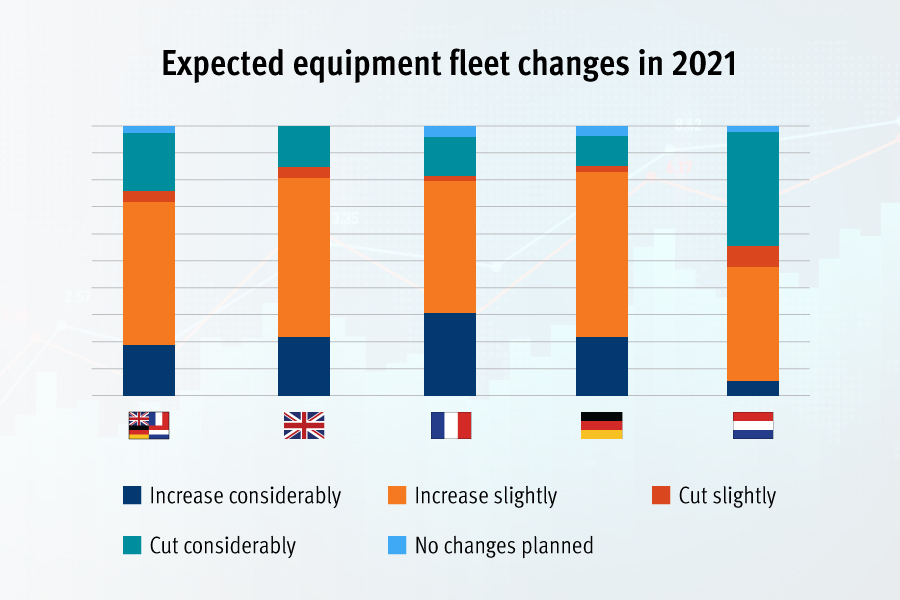

Many construction businesses across Europe are gearing up for an upturn in productivity this year by adding to their equipment fleets, moving towards online buying and selling and looking to credible data to support their fleet management.

These trends were all highlighted during a recent customer survey conducted by Ritchie Bros and backed up by statistics from across its European auctions.

Around 200 construction businesses were surveyed by Ritchie Bros., representing companies from across Germany, The Netherlands, France, and the UK, with fleets ranging between 2-200 equipment items and trucks.

The survey shows that UK plant equipment owners have been holding onto most of their fleet in 2020, with 39% claiming to have sold no machines last year, with demand for new equipment soaring. This compares against a total European survey average of 25%. In addition, with the UK market dominated by plant hirers, 58% of UK respondents said they also expected to rent more equipment, highlighting a ‘top-up’ approach to plant equipment fleets.

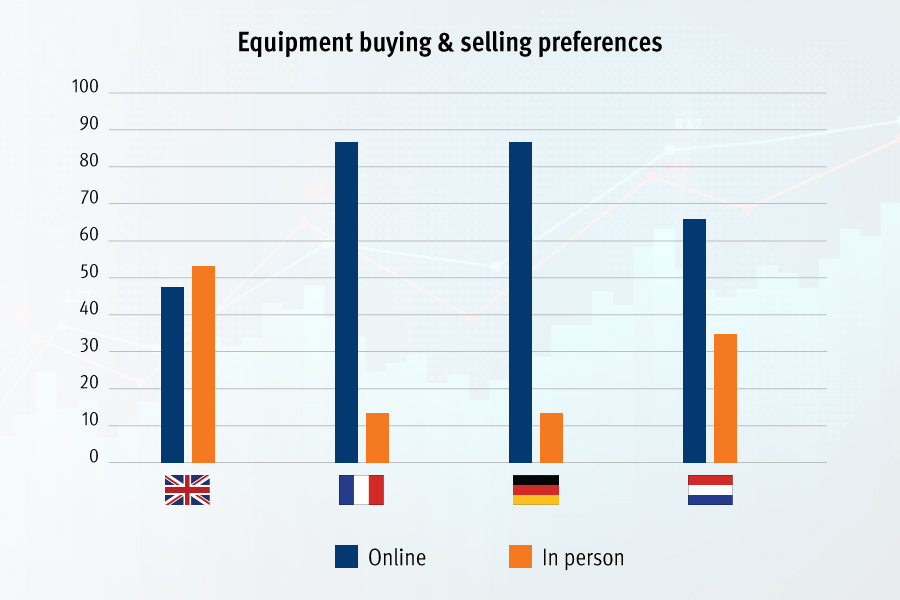

Among the findings, there was almost an equal split between UK customers agreeing that offline was a suitable replacement for online, with 47% agreeing that digital transactions are the way forward and 53% disagreeing with this sentiment. This demonstrates that in the UK market, there is a strong place in the future for both methods of conducting transactions.

Rupert Craven, Sales Director UK & Ireland at Ritchie Bros, comments: “So-called ‘shovel ready’ projects like HS2, housebuilding and the acceleration of broadband rollout programs are really driving demand. But what is also clear is that there continues to be growing confidence and therefore participation in online auctions across the region, which is driving both demand and bidding activity.

“This has continued to grow throughout the pandemic as individuals have built a greater acceptance of both selling and purchasing assets online through trusted providers. This is reflected in the survey results, with 71% of all participating construction businesses seeing using online channels to buy and sell plant machinery as a solid replacement for in-person methods.

“In March 2020 we switched to using our tried and tested timed auction software, previously used for smaller lots like tools. Since this time, we have seen continued growth in registered buyers, engagement and volume of bids. Our own data shows website traffic up 13% over the year with more than 140,500,000 visits, online bidder registrations up 77% to 1.2 million bidders, and accepted bids increasing by 65% to 15 million. And buyer feedback has highlighted features like auto extended which acts as a digital auctioneer, as being an important change to give more time to place additional bids.

“This is what is really driving the market, for example, in the UK 63% of our lots went into extended time at our last auction, compared to 59% in Italy and 69% in Spain. When we look closer into these figures it’s in-demand items like dozers, machine control excavators, ADTs and cranes that businesses are holding on to which are extending for longer.”

Rupert Craven continues: “Buyers from the UK have always seen a benefit in visiting and seeing the equipment in person before placing bids and this is why we have also worked hard to keep our yard in Maltby open and COVID-safe for visitors. Along with this option to personally inspect items at the auction site, we have added more imagery and videos for auction lots listed for sale on their website.”

The growth of online equipment sales has also led to an explosion of data. In parallel, the equipment owners are looking for heavy equipment data to base fleet management decisions on. Fresh market insights, equipment price performance and the ability to identify high-demand regions enable the equipment owner to mitigate risks and bring clarity in fleet management.

Craven concludes: “Using data models and tools, we can see what the market is doing for particular asset groups and adjust the customer’s selling strategy accordingly to optimize returns.”