New app forecasts Asphalt Pricing to lower financial risks

Liquid Asphalt must compete with other products that are refined from crude oil and energy prices are currently soaring due to inflation. Imagine bidding today’s cash price and the cost of the hedge instead of guessing at some future price.

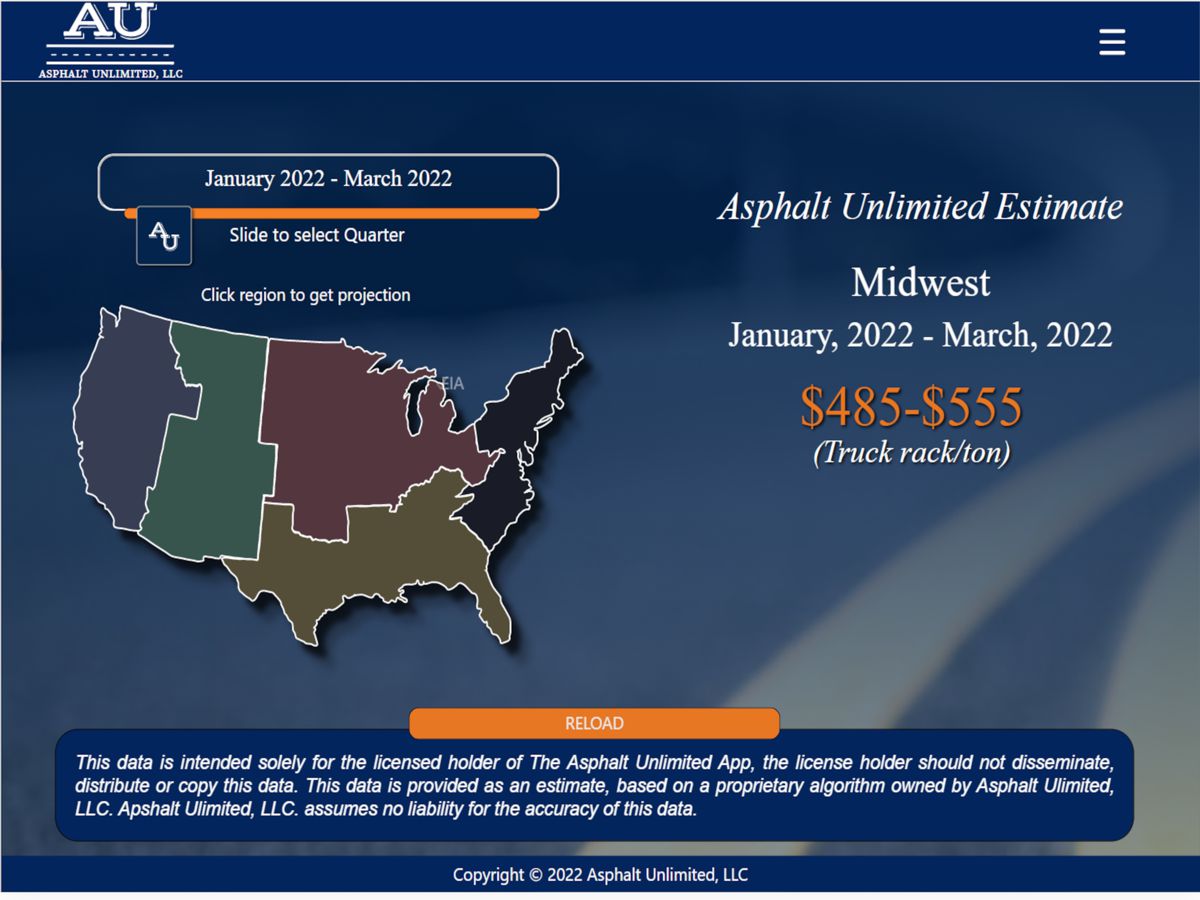

The solution is a new app that forecasts regional future liquid asphalt prices up to 18-months out. Developed by Brian Lawrence, President of Asphalt Unlimited, a 30+ industry expert, to help Asphalt Producers and Highway Contractors bid future work.

This app is based on Asphalt Unlimited’s proprietary algorithm that pulls the daily closing prices of a variety of energy products from the NYMEX and provides an asphalt projection that mirrors the coker values of asphalt.

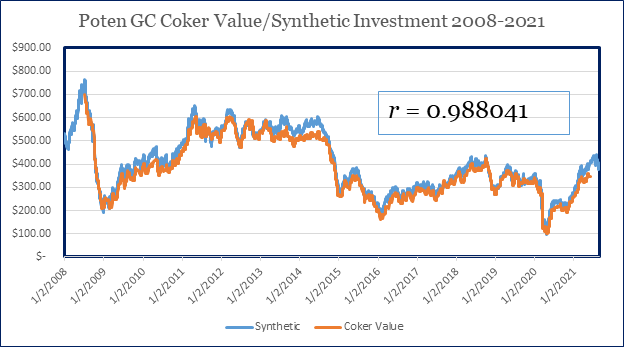

It has been back tested against 13 years of published coker values and it produced a correlation (r-value) of 0.988041. Almost a perfect, positive correlation. This gives the projection an actual basis in reality because it is based on today’s closing futures prices.

“The algorithm never predicted a value below the published value,” states Brian Lawrence, Asphalt Unlimited, LLC. “To me, that fact along with the high degree of correlation (0.988041), provides a lot of confidence when either producing a financial outcome or predicting a future price, whether up or down. I think in the near future, coker values will probably provide the floor for wholesale asphalt pricing anyway.”

The values produced by the app are a retail (rack) projection and are also tailored to specific geographic areas in the 48 contiguous United States. The prices are given in ranges and are suggestive of what is a reasonable value to possibly include in a bid. The app is subscription based and all annual subscribers can receive private asphalt pricing consultation with Brian Lawrence.