How Project Finance Can Power the Transition to Green Ports

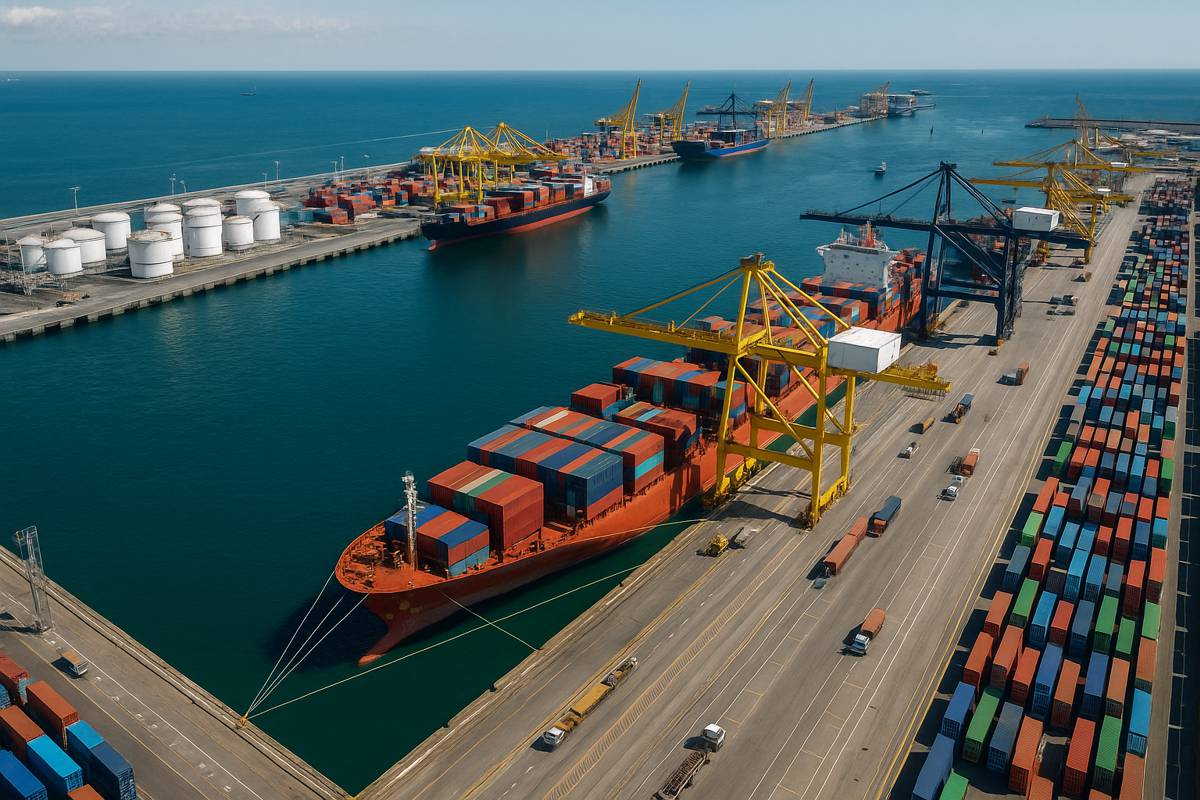

Ports across Asia and the Pacific are the lifeblood of regional and international trade, handling vast volumes of goods that sustain economies and connect markets. Beyond their primary role in commerce, ports support employment, supply chains, and critical services for island and coastal communities. From building materials to food supplies, ports provide a vital link for both everyday needs and emergency relief.

Yet, this economic significance comes at an environmental cost. Port operations are a major source of greenhouse gas emissions, water and air pollution, and habitat disruption. Furthermore, maritime infrastructure is increasingly at risk from climate change impacts such as rising sea levels, stronger storms, and extreme weather events. The challenge is clear: ports must adapt, decarbonise, and become resilient while maintaining their role as trade gateways.

Defining a Green Port

A green port is one that actively minimises its ecological footprint while enhancing its resilience to climate change. This involves embedding sustainability from the planning stage through to daily operations. Such ports adopt renewable energy, energy efficiency measures, sustainable waste and water management, and low-carbon transport solutions. They also prioritise biodiversity, reduce nuisance and pollution, and integrate climate resilience into infrastructure design.

Greening a port is not a one-off transformation but a continual process of improvement, often aligned with the United Nations Sustainable Development Goals (SDGs). This evolving approach allows ports to adapt to emerging technologies, regulations, and climate realities.

The Investment Gap

According to the Global Maritime Forum, halving global shipping emissions by 2050 will require $1.0–$1.4 trillion in cumulative investment. Achieving full decarbonisation pushes the figure to $1.4–$1.9 trillion. The funding gap is particularly acute for ports in developing economies, with UNCTAD estimating an annual shortfall of $8–$28 billion, rising to over $10 billion by 2029–2034.

For many ports, the upfront costs of sustainable infrastructure—such as shore power, hydrogen bunkering, or climate-resilient defences—are prohibitive, especially when returns may take decades to materialise.

Project Finance as a Solution

Project Finance offers a viable pathway to unlock capital for green port developments. By structuring investments around the projected revenues of a specific project, rather than the balance sheet of a port authority, Project Finance can attract both public and private sector partners. This approach mitigates risk for individual stakeholders while mobilising substantial funds for large-scale infrastructure.

Highways.Today’s Project Finance partners provides a framework for structuring such investments to deliver sustainable port projects.

The model can be applied to:

- Renewable energy installations, such as offshore wind or solar farms dedicated to port power needs.

- Shore power systems to enable vessels to plug into clean electricity while docked.

- Hydrogen or ammonia production and bunkering facilities.

- Nature-based solutions like mangrove restoration or wetland creation to protect coastlines.

- Climate-resilient infrastructure upgrades.

The Sustainable and Resilient Maritime Fund (SRMF)

The Asian Development Bank’s proposed SRMF is designed to bridge the financing gap for port decarbonisation. It will provide blended finance, combining concessional loans, grants, guarantees, and equity participation to support projects at three levels:

- Upstream – Supporting policy and institutional development to create an enabling environment for green ports.

- Midstream – Funding feasibility studies, de-risking strategies, and early project development.

- Downstream – Financing capital-intensive projects and direct interventions.

Priority areas include energy efficiency, clean fuels, climate resilience, waste management, integrated water systems, hinterland connectivity, and pollution reduction.

Overcoming Barriers to Green Port Investment

Port stakeholders often face four major barriers:

- Limited funding and financing – High capital costs and slow ROI deter investment.

- Weak regulatory frameworks – Lack of policies can create uncertainty.

- Insufficient technical capacity – Ports may lack expertise in sustainable technologies.

- Low stakeholder awareness – Decision-makers may not fully grasp the benefits or opportunities of green initiatives.

Addressing these barriers requires targeted policy reforms, technical training, stakeholder engagement, and access to tailored financing instruments.

Best Practice Examples

Several ports have demonstrated the benefits of sustainable investments:

- Portsmouth International Port (UK) – Implemented AI-driven energy optimisation, cutting costs and emissions.

- Port of Antwerp (Belgium) – Installed a hydroturbine generating up to 150 kW from tidal flows.

- Port of Rotterdam (Netherlands) – Mandates all new builds meet flood level projections for 2100.

- Port of Newcastle (Australia) – Developing a 40 MW hydrogen hub.

These case studies highlight how innovation, collaboration, and targeted funding can deliver tangible environmental and economic benefits.

Aligning Project Finance with Green Port Goals

Project Finance structures can be aligned with the SRMF’s objectives to deliver sustainable, bankable projects. For example, equity investors can take stakes in renewable energy projects supplying ports, while lenders can provide concessional loans tied to sustainability-linked KPIs. Public–private partnerships can be designed to share risks and rewards, ensuring long-term operational and environmental performance.

The benefits of aligning Project Finance with port decarbonisation include:

- Leveraging private capital to complement public funding.

- Ensuring accountability through contractual performance targets.

- Mobilising global expertise in sustainable infrastructure.

- Creating scalable models replicable across multiple ports.

A Stronger Maritime Future

The transition to green ports is both a necessity and an opportunity. By combining policy reforms, technical innovation, and robust financing structures, Asia-Pacific ports can lead the way in sustainable maritime development. The integration of Project Finance models offers a powerful tool to bridge the investment gap and deliver resilient, low-carbon port infrastructure.

With the right mix of commitment, collaboration, and capital, ports can transform from major sources of emissions into beacons of sustainability, supporting economic growth while safeguarding the planet.