Africa Green Economy Summit to Showcase High Impact Investment Ventures

Africa’s Green Economy Summit (AGES 2026) is preparing to unveil a powerful portfolio of investment-ready ventures that reflect the continent’s growing leadership in sustainable development. The event will host nearly 30 curated projects selected from more than 100 applications evaluated by a committee of experienced investors and industry experts. These initiatives span clean energy, low-carbon logistics, sustainable agriculture, environmental conservation, water resilience, digital technologies, and climate-aligned financial instruments.

The selected ventures illustrate Africa’s rising profile in global climate action, showcasing scalable and commercially viable solutions capable of attracting both public and private capital. AGES 2026 demonstrates the continent’s capacity to deliver measurable climate impacts while strengthening local economies and building resilient infrastructure.

As Elodie Delagneau, Investment Project Lead at VUKA Group, explained: “The overwhelming response and the exceptional quality of applications reaffirm Africa’s immense potential in the green economy. AGES 2026 is not merely a conference; it is the definitive platform where serious capital meets serious impact. Our rigorous vetting process ensures that investors encounter thoroughly de-risked and scalable projects that are poised to deliver both significant financial returns and verifiable environmental and social benefits.”

A Strategic Approach to Green Investment Attraction

The Pitch Programme builds on extensive market analysis to identify the highest-impact ventures capable of delivering both climate outcomes and financial returns. Each selected initiative aligns with sustainable development goals and is structured to scale efficiently. The committee has placed particular emphasis on projects demonstrating strong governance, verifiable data, robust financial models, and a clear pathway to market adoption.

Investors attending AGES 2026 will encounter early-stage, growth-stage, and late-stage commercial propositions, providing portfolio diversity and risk balancing. Africa’s momentum in sustainable development is accelerating, supported by stronger policy frameworks, improved access to renewable energy technologies, and increasing institutional capital flows.

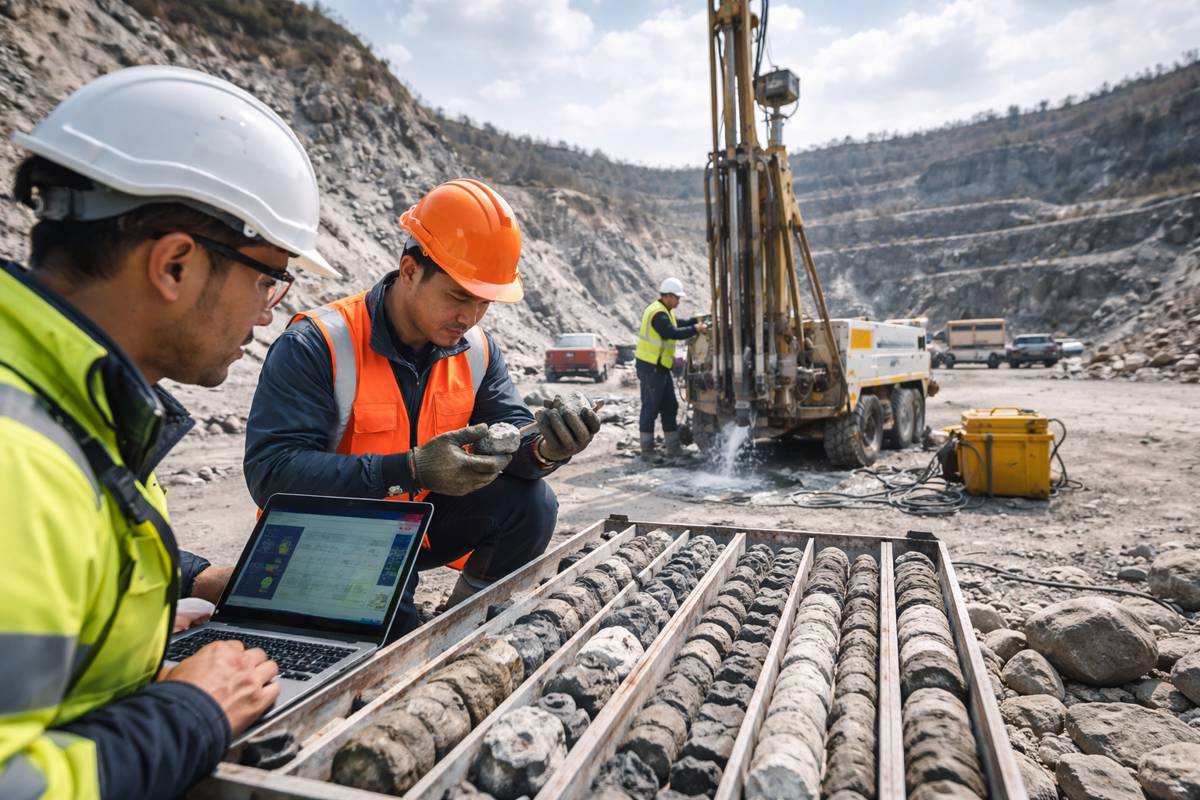

Powering Africa’s Low-Carbon Leap

Energy remains the heartbeat of Africa’s development ambitions. With more than 600 million individuals still lacking electricity access, the continent faces a substantial opportunity to leapfrog traditional infrastructure. Renewable energy now dominates new generation capacity, supported by utility-scale solar farms, onshore wind clusters, advanced mini-grid systems, and emerging green hydrogen projects.

Access to clean energy brings measurable outcomes, including reduced emissions, improved healthcare delivery, enhanced industrial productivity, and better educational opportunities. Africa’s abundant solar and wind resources have already attracted multinational participation and concessional finance, indicating strong investor confidence.

Growth in battery storage, hybrid systems, and cross-border transmission corridors is strengthening regional resilience. Development finance institutions are increasingly backing commercially structured clean energy projects, and philanthropic climate funds are supporting feasibility studies, community ownership models, and early-stage de-risking.

Sustainable Transport and E-Mobility

Transport contributes significantly to urban congestion, fuel consumption, and emissions. AGES 2026 features electric mobility ventures that offer clean logistics and modern urban connectivity. These include electric bus fleets, charging infrastructure, two and three-wheeler mobility platforms, and digital fleet optimisation technologies.

The market potential for electric mobility across African cities is substantial. From Nairobi to Kigali and Lagos, pilot programmes demonstrate that electric fleets reduce total cost of ownership while improving city air quality. New financing models, including pay-as-you-go leasing and battery-as-a-service platforms, are unlocking broader adoption.

Waste and Circular Economy

Circular economy ventures are rapidly gaining traction across African cities. Rapid urbanisation, landfill pressures, and waste-related health challenges create compelling investment opportunities for recycling, reprocessing, waste-to-energy generation, material harvesting, and biological composting.

Projects targeting construction debris recycling, plastics processing, anaerobic digestion, and invasive-species conversion present attractive commercial potential. The circular economy reduces landfill volumes, lowers methane emissions, generates new revenue models, and supports clean manufacturing.

Water Security and Climate Resilience

Climate change is intensifying droughts, flooding, saltwater intrusion, and disruptions to water availability. AGES 2026 features projects that bolster water resilience through decentralised purification, catchment management, groundwater monitoring, and smart irrigation.

Secure water resources underpin public health, food security, manufacturing, and regional trade. Digital water monitoring platforms, pressure optimisation systems, and resilience engineering are rapidly improving water efficiency and reducing disruptions to critical infrastructure.

Agriculture and Food Systems Innovation

Agriculture remains Africa’s foundational economic sector, supporting more than half of the continental workforce. Sustainable agricultural ventures presented at AGES 2026 highlight climate-resilient production, regenerative soil management, biochar fertilisers, seed optimisation, cold-chain innovation, and integrated agri-tech platforms.

Digital crop intelligence and data-led farm management are redefining how farmers increase productivity while cutting emissions. Sustainable practices such as drip irrigation, drought-resistant crop strains, organic fertilisers, and regenerative grazing are gaining institutional support from donors, agribusinesses, and climate funds.

Biodiversity and Conservative Capital Deployment

Africa holds some of the world’s most important biodiversity and natural carbon sinks. Ventures supporting nature-based finance, forest restoration, ecological monitoring, invasive species removal, watershed rehabilitation, and blue carbon platforms are increasingly viable.

REDD+ credit programmes, protected-area financing, wildlife-tourism conservation, and coastal restoration are delivering measurable climate outcomes while benefiting local communities. Investors now recognise the economic value of safeguarding ecosystem assets and nature-based tourism.

Digitalisation and Climate Technology

Africa’s climate-tech ecosystem is expanding rapidly. Digital tools support energy optimisation, agricultural analytics, water efficiency, supply chain transparency, and carbon measurement. IoT sensors, artificial intelligence, and blockchain systems lower operational costs and increase scalability.

Market data shows rapid growth in climate-focused digital start-ups across Kenya, South Africa, Nigeria, Rwanda, and Ghana. Many platforms integrate payment systems, micro-insurance, and carbon-credit measurement, enhancing commercial viability and enabling cross-sector partnerships.

Carbon Markets and Climate Finance

Carbon markets are evolving into a major instrument for climate financing. Africa’s potential for generating high-integrity carbon credits is vast, encompassing renewable energy deployment, avoided deforestation, mangrove restoration, regenerative agriculture, biogas, and methane capture.

Global buyers increasingly demand traceable, high-quality credits with demonstrable social benefits. Africa’s projects are well positioned to supply these, provided robust monitoring, reporting, and verification systems are in place. Carbon revenues are also strengthening community livelihoods and environmental stewardship.

Connecting Capital With Opportunity

The summit offers a complete investment ecosystem that accelerates deal structuring and real-world deployment. Investors will participate in structured matchmaking sessions, curated networking opportunities with development finance institutions, corporate sustainability leaders, policymakers, and impact fund managers.

As Delagneau highlighted: “The Pitch Programme offers an unparalleled opportunity for investors to engage directly with the innovators shaping Africa’s green future. Beyond the pitches, attendees will benefit from purpose-built matchmaking sessions, networking opportunities with leading DFIs, corporate partners, and policymakers, and deep insights into the continent’s evolving green economy landscape. Our goal is to significantly accelerate deal flow and ensure that every investor finds projects that align with their financial and impact mandates.”

Each participating project receives structured mentorship to strengthen business models, refine investor materials, and enhance presentation outcomes. This ensures that promising ventures progress toward bankability and long-term commercial deployment.

Accelerating Africa’s Just Transition

AGES 2026 demonstrates Africa’s capability to deliver scalable green solutions that address climate mitigation, adaptation, job creation, industrial growth, and environmental stewardship. The summit showcases the continent’s momentum toward energy transition, resilient infrastructure, equitable mobility, sustainable food systems, and thriving circular economies.

Africa’s just transition requires catalytic financing, policy alignment, and collaborative partnerships. AGES 2026 provides a platform where global capital meets credible project delivery, strengthening Africa’s role as a pioneer in climate-aligned economic transformation.

Continental Innovation

The summit reinforces a long-term investment narrative: Africa offers a rapidly expanding pipeline of commercially structured, impact-driven ventures capable of transforming essential sectors.

As capital flows increase, early-stage climate innovation, nature conservation, and sustainable infrastructure will accelerate across cities, towns, and rural landscapes.