Physical AI and Humanoid Robots Moving From Theory to the Jobsite

The conversation around artificial intelligence has spent much of the past decade focused on software. Algorithms that can see, predict, recommend and optimise have transformed offices, trading floors and design studios. Yet, for industries rooted in the physical world such as construction, manufacturing, logistics and infrastructure delivery, that first wave of AI has only scratched the surface. According to new analysis from Barclays Research, the next phase of AI’s evolution will not live solely in data centres or dashboards. It will walk, lift, carry and operate alongside human workers.

In its latest Impact Series report, The Future of Work: AI Gets Physical, Barclays Research positions humanoid robots as a structural inflection point for global industry. Designed with a human-like form factor and increasingly capable of navigating complex, unstructured environments, these systems are moving out of controlled laboratories and into real-world settings. The implications stretch far beyond novelty robotics. For sectors grappling with labour shortages, ageing workforces and rising productivity pressures, humanoid robots could become a practical tool rather than a futuristic curiosity.

Crucially, this shift is not framed as a story of wholesale workforce replacement. Instead, the report argues that humanoids are likely to augment human labour, taking on repetitive, physically demanding and ergonomically risky tasks. In construction and infrastructure, where manual handling, inspection and on-site logistics remain stubbornly difficult to automate, that distinction matters. It reframes physical AI as an enabler of safer, more resilient operations rather than a blunt instrument of job displacement.

Physical AI for Construction and Infrastructure

Construction and infrastructure projects remain among the least digitised segments of the global economy. Despite advances in BIM, digital twins and autonomous equipment, many core tasks still depend on human physical presence. Site conditions change daily. Spaces are uneven, cluttered and unpredictable. Unlike factories, jobsites rarely offer the controlled environments traditional robots require.

Humanoid robots are explicitly designed to bridge that gap. By mirroring human proportions and movement patterns, they can operate within spaces already optimised for people. Doorways, staircases, scaffolding and vehicle cabins become navigable rather than obstructive. For infrastructure owners and contractors, this compatibility lowers the barrier to adoption, reducing the need for costly site redesigns.

The strategic relevance becomes clearer when viewed through a demographic lens. Many developed economies face shrinking working-age populations and a decline in skilled trades. Construction firms across Europe, North America and parts of Asia report persistent difficulties in recruiting and retaining labour for physically demanding roles. In this context, humanoids represent a potential pressure valve, sustaining project delivery capacity without relying on an ever-diminishing pool of workers.

The Economics Behind the Breakthrough

One of the most striking findings in the Barclays Research report is the pace at which humanoid robot economics have shifted. Over the past decade, advances across three core domains have driven a dramatic reduction in production costs. Barclays describes these as the ‘three Bs’: brains, brawn and batteries.

On the software side, improvements in AI reasoning and perception have enabled robots to interpret complex environments with increasing reliability. Vision systems, sensor fusion and real-time decision-making have matured to the point where autonomous operation in semi-structured settings is viable. That capability underpins any meaningful deployment in construction, logistics or healthcare.

The second pillar, brawn, refers to physical motion and actuation. Actuators function as robotic muscles, converting electrical signals into precise, controlled movement. According to Barclays, these components account for roughly half of a humanoid robot’s total production cost. Advances in actuator design, materials and manufacturing techniques have significantly reduced costs while improving durability and energy efficiency.

Battery technology completes the triad. Higher energy densities, faster charging and longer operational lifespans allow humanoids to function for extended periods without frequent downtime. For infrastructure projects operating on tight schedules, that reliability is not optional. It is a prerequisite.

Combined, these advances have driven an estimated 30-fold reduction in production costs over the past decade. That decline is what shifts humanoid robots from experimental platforms into commercially credible assets.

Market Scale and the Investment Case

Barclays Research estimates the current global humanoid robotics market at between $2 billion and $3 billion. On its own, that figure barely registers against the broader automation landscape. However, under optimistic adoption scenarios, the report suggests the market could expand to as much as $200 billion by 2035.

Such growth would place humanoids alongside some of the largest industrial technology segments, reshaping supply chains and capital allocation priorities. Importantly, the value creation is expected to tilt towards hardware rather than software. While the first wave of AI disproportionately rewarded data platforms and cloud providers, physical AI shifts attention to component manufacturers, integrators and industrial automation specialists.

For investors and policymakers, this rebalancing carries strategic weight. Actuator manufacturers, precision engineering firms and advanced materials suppliers could find themselves at the centre of a new industrial cycle. Many of these companies sit outside the traditional technology spotlight, despite deep expertise and established manufacturing capabilities.

Europe’s Industrial Advantage

The report highlights Europe as a potential beneficiary of this transition. The continent’s long-standing strengths in automotive manufacturing, robotics and precision engineering align closely with the needs of humanoid production. In particular, actuator systems draw heavily on competencies developed within the automotive supply chain.

European manufacturers have decades of experience producing high-tolerance mechanical components at scale. Gearboxes, motors, sensors and control systems used in vehicles share similarities with those required in humanoid robots. This industrial overlap provides a natural foundation for participation in the physical AI economy.

From a policy perspective, this presents an opportunity to reinforce industrial competitiveness. Investment in robotics supply chains could support skilled manufacturing jobs while positioning Europe as a key node in a rapidly expanding global market.

China’s Rapid Acceleration

While Europe holds structural advantages, China is emerging as a dominant force in humanoid robotics development. Barclays Research notes that the majority of new humanoid robot models are now originating from Chinese companies. Supported by aggressive scaling strategies and an integrated manufacturing ecosystem, China’s innovation cycle is accelerating rapidly.

This dynamic mirrors earlier patterns seen in electric vehicles and renewable energy technologies. Early investment, domestic demand and state-backed industrial strategies have allowed Chinese firms to compress development timelines and reduce costs. For global construction and infrastructure markets, this raises questions around supply chain resilience, standards and interoperability.

At the same time, increased competition could accelerate adoption worldwide. As costs fall and performance improves, humanoid robots become accessible to a broader range of industries and geographies.

Implications for Labour and Industrial Strategy

The societal impact of humanoid robots inevitably raises concerns about employment. Barclays Research addresses this directly, framing physical AI as a response to labour scarcity rather than surplus. In sectors already struggling to fill roles, humanoids may stabilise operations rather than displace workers.

This perspective is particularly relevant for infrastructure maintenance, logistics hubs and healthcare facilities. Tasks involving heavy lifting, repetitive motion or hazardous environments are often the hardest to staff. Deploying robots in these roles could reduce injury rates, extend workforce participation and improve overall productivity.

Zornitsa Todorova, Head of Thematic FICC Research at Barclays, summarises the significance: “Humanoid robots represent a structural shift in automation. As they move from concept to commercial reality, the implications for labour markets and industrial strategy are profound.”

For governments, the challenge lies in aligning education, regulation and investment frameworks with this emerging reality. Supporting workforce reskilling, establishing safety standards and encouraging domestic manufacturing capacity will shape how benefits are distributed.

From Software-Centric AI to Physical Intelligence

The rise of humanoid robots underscores a broader transition within the AI landscape. The initial phase of AI adoption focused on data, analytics and digital optimisation. That phase delivered significant gains but left large portions of the physical economy relatively untouched.

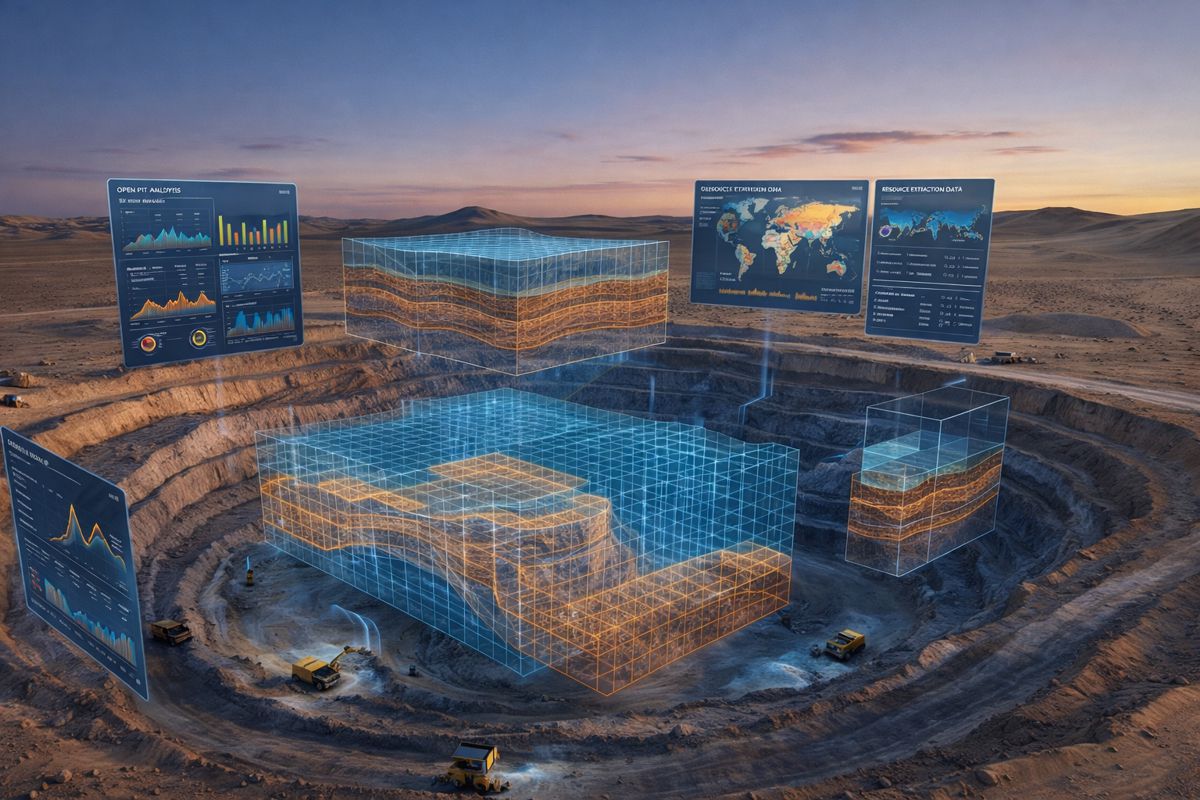

Physical AI extends intelligence into the built environment. For construction and infrastructure, this could mean autonomous material handling, robotic inspection of confined spaces or on-site support for skilled trades. Over time, integration with digital twins and project management platforms could enable seamless coordination between virtual planning and physical execution.

This convergence reinforces the idea that AI’s next chapter will be written as much in steel, motors and batteries as in code. For industries grounded in the real world, that shift could prove transformative.

Reframing the Future of Work

Barclays’ Impact Series positions humanoid robotics not as a speculative technology but as an emerging industrial theme with tangible implications. By grounding its analysis in demographics, cost structures and supply chain dynamics, the report moves beyond headline-grabbing projections.

For construction professionals, investors and policymakers, the message is clear. The future of work will not be shaped by software alone. Physical AI is arriving, and its impact will be felt on factory floors, logistics centres and jobsites worldwide.

The opportunity now lies in preparing for that transition. Companies that understand where value is likely to accrue, and regions that align industrial policy accordingly, may find themselves well placed as AI quite literally steps into the physical world.