Capital Planning in the Age of AI Infrastructure

Artificial intelligence has crossed a threshold that few in the construction and infrastructure world can now afford to ignore. What began as an operational tool embedded in software platforms has rapidly evolved into a capital-intensive infrastructure challenge, one that increasingly resembles power generation, transport logistics, or telecoms networks in scale and complexity. As AI workloads expand, the physical infrastructure required to support them is no longer a background consideration but a central pillar of capital planning.

The rapid growth of AI compute demand is forcing CFOs, infrastructure sponsors, and investors to rethink how projects are financed, owned, and risk-managed. High-density data centres, specialised power systems, advanced cooling technologies, and dedicated grid connections are now being planned at a scale previously reserved for heavy industrial facilities. This shift has placed AI infrastructure firmly within the orbit of construction, engineering, and long-term asset financing.

According to analysis published by DataCenterKnowledge, the financing landscape for AI infrastructure has entered a new phase. Traditional models built around incremental data centre expansion are proving insufficient for the scale and speed now required. Instead, hybrid financing structures that blend equity, project debt, and long-term offtake agreements are emerging as the preferred route for unlocking capital while managing volatility.

Why Financing Models Matter More Than Ever

AI infrastructure differs from earlier generations of digital infrastructure in one critical respect: capital intensity arrives upfront. High-performance compute clusters demand significant investment before any meaningful revenue can be realised. This reverses the historic model where digital infrastructure could be expanded gradually, funded largely through operating cash flows.

For construction firms, engineering contractors, and infrastructure developers, this changes the risk profile of projects from the outset. AI-driven facilities require specialised buildings, reinforced power systems, and mechanical infrastructure that must be designed and delivered to precise specifications. Errors, delays, or underutilisation can quickly erode returns, particularly when financing costs are rising.

From a financial perspective, the challenge is not simply raising capital, but structuring it in a way that aligns with uncertain demand curves, evolving technology cycles, and long asset lives. Unlike traditional infrastructure, where utilisation is often predictable over decades, AI workloads are subject to rapid shifts driven by software innovation, regulatory frameworks, and geopolitical constraints on energy and supply chains.

Blending Debt and Equity in New Ways

One of the most significant developments highlighted by industry analysts is the move away from binary financing decisions. Rather than choosing between debt-heavy or equity-led structures, project sponsors are increasingly blending the two to create flexible capital stacks tailored to AI infrastructure risk.

Debt financing remains attractive, particularly where long-term contracts with hyperscalers or enterprise clients provide predictable cash flows. However, lenders are becoming more cautious. High power consumption, exposure to energy price volatility, and the pace of technological change all introduce risks that must be priced into lending terms.

Equity investors, meanwhile, are showing renewed interest in AI infrastructure as a standalone asset class. Institutional investors that once focused on transport, utilities, and social infrastructure are now allocating capital to digital assets with physical footprints. This includes pension funds, sovereign wealth funds, and infrastructure-focused private equity firms seeking long-duration returns.

The result is a growing preference for layered financing structures. Senior debt may be supported by mezzanine tranches, preferred equity, or strategic co-investment from technology partners. These arrangements allow risk to be distributed more evenly while preserving flexibility for future expansion or repurposing of assets.

Construction Risk Moves Up the Agenda

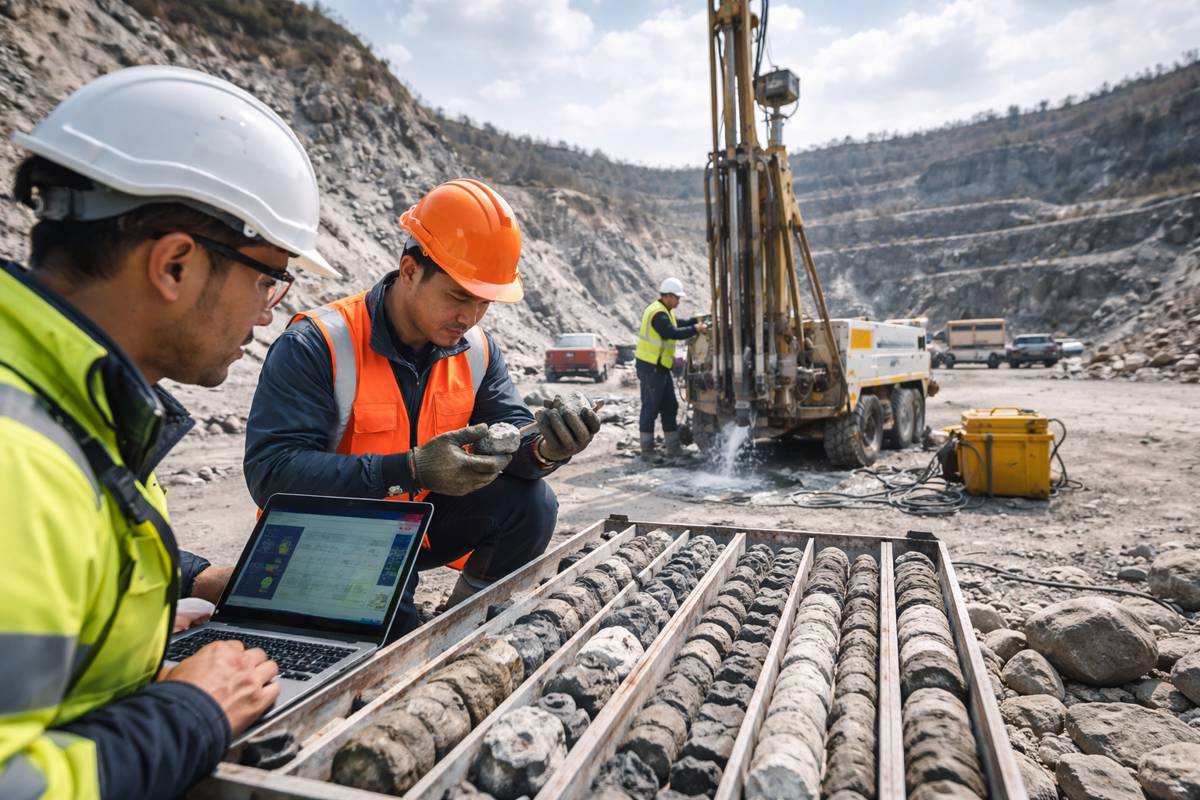

As financing models evolve, construction risk is receiving far greater scrutiny. AI infrastructure projects are unforgiving environments where delays can cascade into lost revenue, contractual penalties, and increased financing costs. This has placed contractors and engineering firms under pressure to demonstrate not just delivery capability, but financial resilience.

Fixed-price contracts, once common in data centre construction, are being re-examined. Volatile material costs, supply chain disruptions, and labour shortages have made rigid pricing structures increasingly difficult to sustain. Instead, more collaborative contract models are emerging, sharing risk between developers, contractors, and financiers.

From a lender’s perspective, the construction phase is now viewed as one of the most critical risk windows. Detailed due diligence on contractor track records, procurement strategies, and contingency planning has become standard. For construction firms, this represents both a challenge and an opportunity. Those able to demonstrate reliability, transparency, and technical expertise are better positioned to secure long-term roles in repeat AI infrastructure programmes.

Power and Energy Infrastructure as a Financing Constraint

Few aspects of AI infrastructure have reshaped financing discussions more dramatically than energy. High-density AI compute facilities consume vast amounts of electricity, often rivalling small towns or industrial plants. Securing reliable, affordable power has become a central concern for CFOs and project sponsors alike.

In many regions, grid capacity is already constrained. This has forced developers to consider alternative energy strategies, including on-site generation, power purchase agreements, and partnerships with renewable energy providers. While these approaches can enhance sustainability credentials, they also introduce additional layers of complexity into financing structures.

Energy infrastructure is no longer a peripheral consideration bundled into operating expenses. Instead, it is increasingly treated as a co-equal asset alongside the data centre itself. Financing models are adapting accordingly, with some projects separating energy assets into distinct investment vehicles while others integrate them into unified infrastructure platforms.

For construction and engineering firms, this convergence of digital and energy infrastructure creates new opportunities. Expertise in grid connections, substations, energy storage, and resilience planning is becoming as valuable as experience in traditional building systems.

Managing Technology Obsolescence Risk

A recurring concern for investors is the pace of technological change in AI hardware. Compute equipment can become outdated far more quickly than the physical structures that house it. This mismatch between asset lifespans complicates traditional infrastructure financing assumptions.

To address this, financing strategies are increasingly focused on flexibility. Modular design approaches allow facilities to be upgraded or reconfigured without wholesale reconstruction. Lease structures for equipment, rather than outright ownership, are also gaining traction, shifting obsolescence risk away from asset owners.

From a capital planning perspective, this reinforces the importance of separating core infrastructure from technology layers. Buildings, power systems, and cooling infrastructure are treated as long-life assets, while compute hardware is financed and depreciated on shorter cycles. This separation enables more accurate risk pricing and improves the attractiveness of projects to long-term investors.

AI Infrastructure and the Rise of Platform Financing

Another notable trend is the emergence of platform-based financing models. Rather than funding individual facilities in isolation, developers are creating portfolios of AI infrastructure assets under unified management structures. This approach allows capital to be deployed more efficiently while smoothing risk across multiple sites and markets.

Platform financing also appeals to institutional investors seeking scale. By investing in a portfolio rather than a single project, they gain exposure to AI infrastructure growth without concentrating risk in one location or technology configuration. For sponsors, platforms offer the flexibility to add new assets, refinance existing ones, and adapt to changing demand.

Construction firms stand to benefit from this shift as well. Long-term platform relationships can provide greater pipeline visibility, enabling investment in specialist skills, digital delivery tools, and workforce development. In effect, financing innovation is reshaping not just capital markets but the structure of the construction supply chain itself.

Implications for Global Infrastructure Policy

Beyond individual projects, the financing of AI infrastructure is beginning to influence national and regional infrastructure strategies. Governments are increasingly aware that AI capacity underpins economic competitiveness, national security, and technological sovereignty. This recognition is driving policy interventions that affect financing conditions.

In some jurisdictions, public-private partnerships are being explored to accelerate AI infrastructure deployment. Incentives such as tax credits, accelerated depreciation, and grid prioritisation are being used to attract private capital. While these measures can improve project viability, they also introduce regulatory considerations that financiers must navigate carefully.

For policymakers, the challenge lies in balancing rapid deployment with long-term resilience. Over-reliance on private capital without adequate safeguards could expose economies to systemic risks, particularly where energy infrastructure and digital capacity become tightly coupled. As a result, financing frameworks are likely to remain an active area of policy development.

Construction and Infrastructure Firms Face a Strategic Choice

For companies operating in construction, engineering, and infrastructure delivery, the rise of AI infrastructure financing is more than a market trend. It represents a strategic inflection point. Firms that view AI facilities as just another building typology risk being sidelined as projects grow in complexity and financial sophistication.

Those that engage early with financiers, understand evolving capital structures, and adapt delivery models accordingly are better positioned to secure long-term roles. This includes investing in digital design, energy integration expertise, and financial literacy across project teams.

AI infrastructure is not a passing phase. It is becoming embedded in the physical fabric of modern economies. Financing strategies will continue to evolve, but the underlying reality is clear: capital planning for AI has become a core infrastructure challenge, reshaping how projects are conceived, funded, and delivered across the global construction ecosystem.

A New Era of Capital Planning Takes Shape

As AI infrastructure matures, its financing models are beginning to resemble those of traditional infrastructure sectors, albeit with added layers of technological and energy risk. The blending of debt and equity, the rise of platform financing, and the integration of energy assets all point to a more sophisticated, capital-intensive future.

For investors, the opportunity lies in recognising AI infrastructure as a durable asset class rather than a speculative technology play. For construction and engineering firms, the opportunity lies in aligning delivery capabilities with the expectations of modern infrastructure finance.

Ultimately, the way AI infrastructure is financed will shape not only digital capacity but the broader construction and infrastructure landscape. As capital planning adapts, so too must the industries responsible for turning financial models into physical reality.