Telematics and IoT technology makes driving safer, cheaper and greener

At the CBI Annual Conference, Anne Sheehan, Enterprise Director for Vodafone outlined how Internet of Things (IoT) technology and a partnership with Admiral Insurance is helping to make driving safer, cheaper and greener.

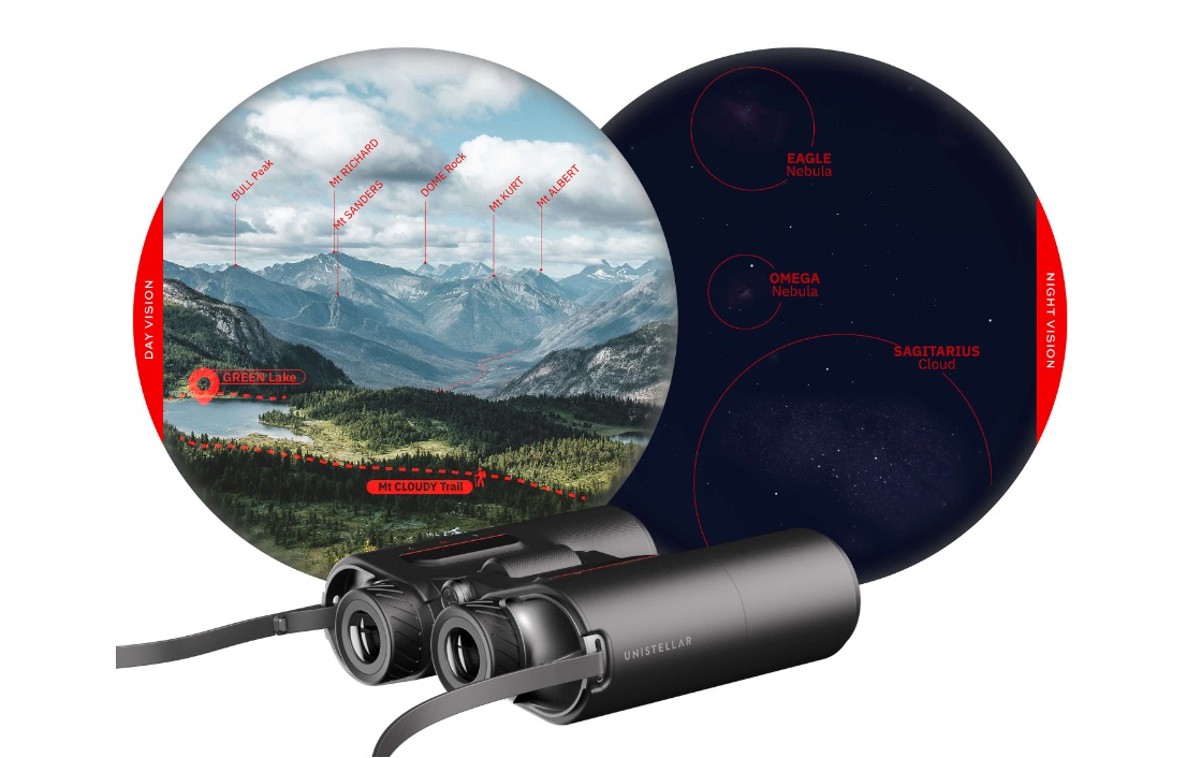

On stage with Gunnar Peters, Admiral’s Head of Telematics, she outlined how Vodafone’s connectivity and secure data processing helps Admiral Insurance assess responsible driving and price their policies accordingly. It also provides instant data in the event of a crash. This means the emergency services can be called; and also speeds up any claims process. These policies are known as Usage Based Insurance (UBI).

Adoption of UBI across Europe is currently low – Italy leads the way with 17% of policies and the UK follows with around 2% of policies. However, new research from Vodafone suggests widespread driver support for telematics, providing there is a benefit:

- 63% of respondents are ‘open’ or ‘could be persuaded’ to have technology in their vehicles if it resulted in rewards for safer driving.

- The biggest incentive for take-up would be a reduction in insurance premiums (68%), followed by reduced fuel costs (62%) and then reduced environmental impact (48%).

Anne commented: “As the global leader in IoT, with over 70 million connections around the world, we understand the potential it has to change the way we all do business. In the insurance world, we’ve seen how telematics can increase customer loyalty and enable organisations to create tailored solutions. As well as the immediate benefits of encouraging more efficient driving, telematics can pave the way for exciting developments in the future. For example, it could be used to provide live data on traffic flows, accurate weather reporting and vehicle-2-vehicle communications to help reduce the risk of collisions.”

Vodafone is the digital telematics partner for Admiral Insurance, the UK’s largest car insurance provider. Vodafone provides the underlying telematics services for the Admiral LittleBox offer, including devices, connectivity, data management and crash analysis. This results in an approach to customer claim handling which is increasingly data-led and integrated with additional services for the customer. The ‘black box technology’, delivered through IoT networks, monitors speed, acceleration, braking and manoeuvring around corners. It rewards responsible driving with lower premiums.

Businesses, as well as consumers, are seeing the positives of IoT technology. In Vodafone’s Digital, Ready? report, to be published soon, over half (58%) of business leaders believe embracing IoT technology is essential to be successful; and 31% of all organisations intend to adopt IoT in the next two years.