Granite REIT announces C$330.7m acquisitions in Canada and Texas

Granite Real Estate Investment Trust announced today that it has acquired one development property in Canada and has agreed to acquire five income-producing properties in the United States together comprising approximately 4.2 million square feet at a combined purchase price of approximately C$330.7 million.

In addition, Granite announced that it has entered into a 690,000 square foot build-to-suit lease with a leading e-commerce retailer, to be constructed as the second phase of its Houston development.

Kevan Gorrie, Granite’s President and Chief Executive Officer commented that: “These transactions reflect our ongoing commitment to developing and acquiring institutional-quality assets in key distribution and e-commerce markets in Canada, the U.S. and Europe. The acquisition of the development site provides us with the opportunity to leverage our platform and expertise to develop state-of-the-art facilities at scale in an active and rapidly-growing distribution node. Upon stabilization, the Brantford development is expected to generate significant NAV growth for our unitholders. We are also pleased to add scale in our target markets in the U.S. via the acquisitions of the income-producing properties. These modern assets are consistent with the quality of our existing portfolio and possess strong potential for NOI and NAV growth. Finally, we are excited to announce our first major Build-to-Suit project in Houston, which will complement the initial phase of our development already in progress. This build-to-suit project, involving a national e-commerce tenant, will generate a yield consistent with our pro forma development yield for the overall project.”

Canadian Acquisition

Brantford, Ontario Development Land: On August 16, 2021, Granite acquired a 92.2 acre parcel of land in Brantford, Ontario for the development of a multi-phased business park comprising a total of approximately 1.7 million square feet of modern distribution and logistics space for $62.2 million. The greenfield site is serviced and capable of accommodating state-of-the-art buildings ranging from 100,000 square feet to 500,000 square feet with the first phase of construction anticipated to commence in the third quarter of 2022. The project is anticipated to generate a stabilized development yield of approximately 5.5%. The site is centrally located 0.5 kilometers from Highway 403, in one of Brantford’s rapidly evolving distribution nodes, providing access to nearly 8.8 million people within a 90-minute drive. The property is one of the development properties referred to in Granite’s June 2, 2021 press release as being the subject of exclusive negotiations.

U.S. Acquisitions

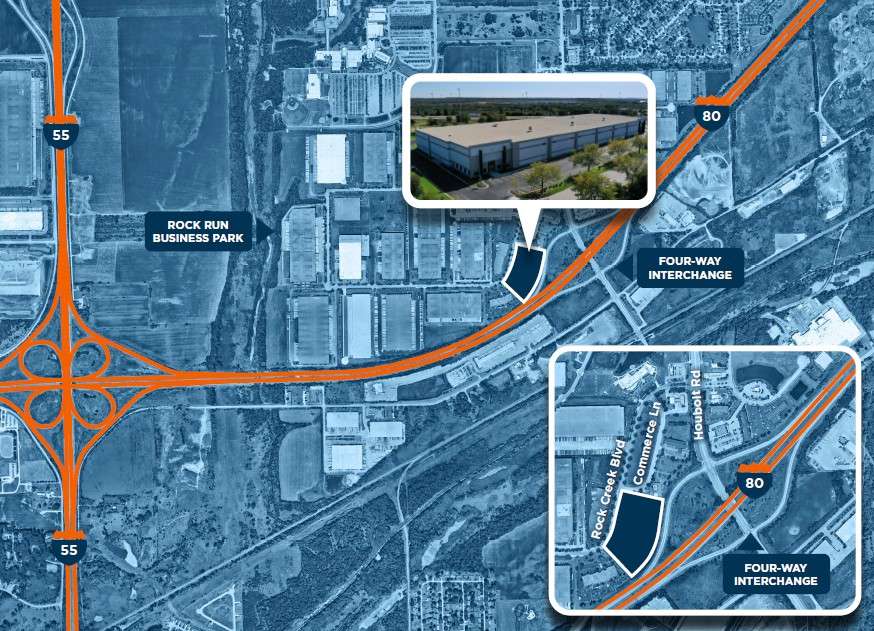

Illinois – 1600 Rock Creek Boulevard, Joliet, IL – Granite has agreed to acquire a 0.1 million square foot modern distribution facility located in the Chicago submarket of Joliet, IL for $20.8 million (US $16.4 million). The property is 100% leased to two tenants for a weighted average remaining lease term of 4.4 years and is being acquired at an in-going yield of 4.9%. Located in immediate proximity to Granite’s three recently acquired assets in Chicago, the building features 32’ clear height and is situated on 8 acres of land, near the intersection of the I-55 and I-80. The acquisition is subject to customary closing conditions and is expected to close in the third quarter of 2021. The property is one of the income-producing properties referred to in Granite’s June 2, 2021 press release as being the subject of exclusive negotiations.

Chicago – (0.4 million square feet) – 1243 Gregory Dr., Antioch, IL

Cincinnati – (0.7 million square feet) – 60 Logistics Blvd., Richwood, KY

Memphis – (1.3 million square feet) – 12577 Stateline Rd. Olive Branch, MS & 8740 South Crossroads Dr., Olive Branch, MS

Granite has agreed to acquire a portfolio of four modern distribution warehouses located in Chicago, Cincinnati and Memphis, collectively totaling 2.4 million square feet. The properties are being acquired at a combined purchase price of approximately $247.7 million (US $195.0 million) representing an in-going yield of 4.7%. The properties are 100% leased to seven tenants for a weighted average remaining lease term of 3.2 years. These institutional-quality assets have minimum 32’ clear heights with an average age of 8 years. All of the assets are well located in their respective markets, with close proximity to key transportation and distribution infrastructure. The acquisition is subject to customary closing conditions and is expected to close in the third quarter of 2021.

The Canadian acquisition was funded using cash on hand and the U.S. acquisitions are expected to be funded from Granite’s cash on hand.

Houston Development

Granite and its partner NorthPoint Development have entered into a new build-to-suit lease with a leading e-commerce retailer at its Houston Development NorthPoint 90, for an initial term of 10.9 years.

The approximately 690,000, 40’ clear height, modern distribution building is being constructed as the second phase of the multi-phase development, in addition to the initial phase one of approximately 700,000 square feet currently under construction. This build-to-suit project is estimated to be completed in the third quarter of 2022.