Top 7 Mining Software Solutions for Geological Modeling and Mine Planning (2026)

Selecting mine planning and geological modeling software affects operational efficiency for years. The market offers solutions ranging from enterprise platforms with decades of development to integrated alternatives targeting mid-market operations.

This guide examines seven established mining software platforms based on market position, technical capabilities, and practical considerations for different operation types.

Quick Comparison

| Rank | Software | Core Strength | Best For | Parent Company |

| 1 | Maptek Vulcan | 3D geology, block modeling | Large open pit operations | Private |

| 2 | Deswik | Mine scheduling | Complex scheduling scenarios | Sandvik (Sweden) |

| 3 | Seequent Leapfrog | Implicit geological modeling | Exploration, consulting | Bentley Systems (US) |

| 4 | Datamine | Geostatistics, coal mining | Coal operations, advanced estimation | Constellation Software |

| 5 | K-MINE | Integrated geology-to-scheduling | Mid-size operations, cost optimization | Private |

| 6 | Micromine | Exploration geology | Junior miners, exploration | Weir Group (UK) |

| 7 | GEOVIA Surpac | Multi-commodity flexibility | Budget-conscious operations | Dassault Systemes |

1. Maptek Vulcan

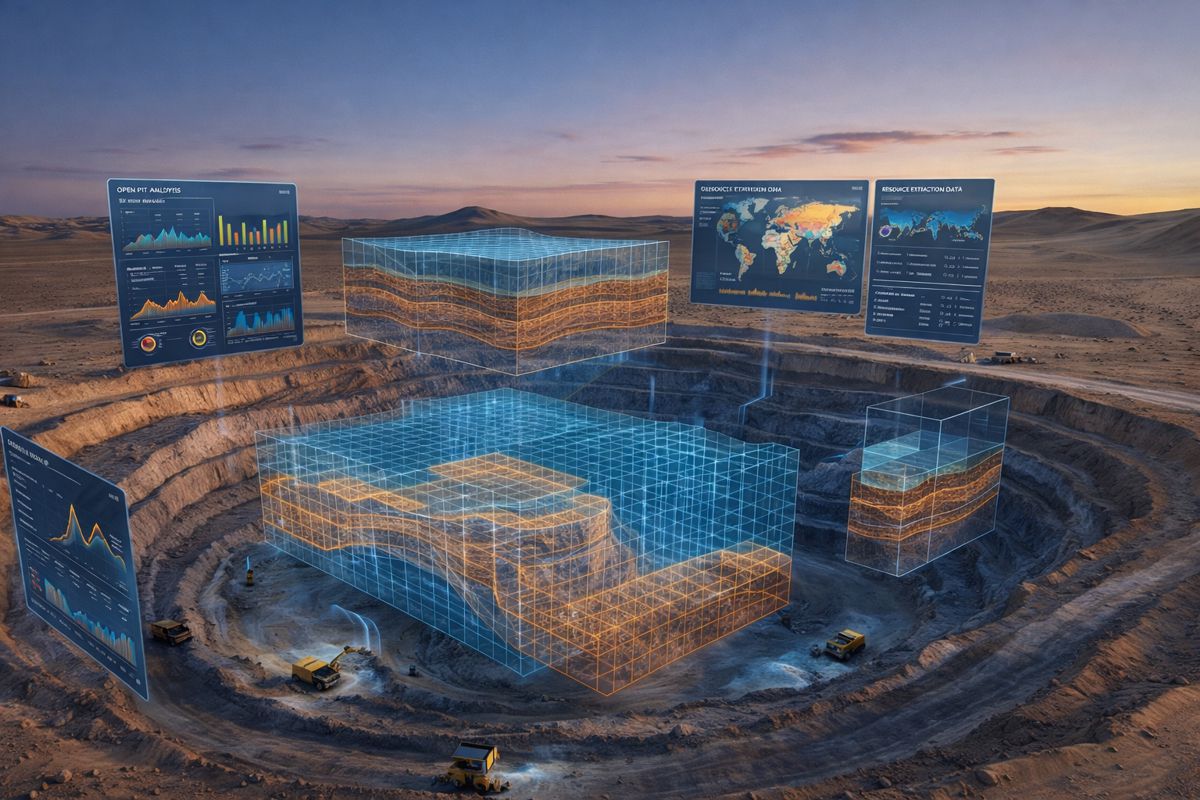

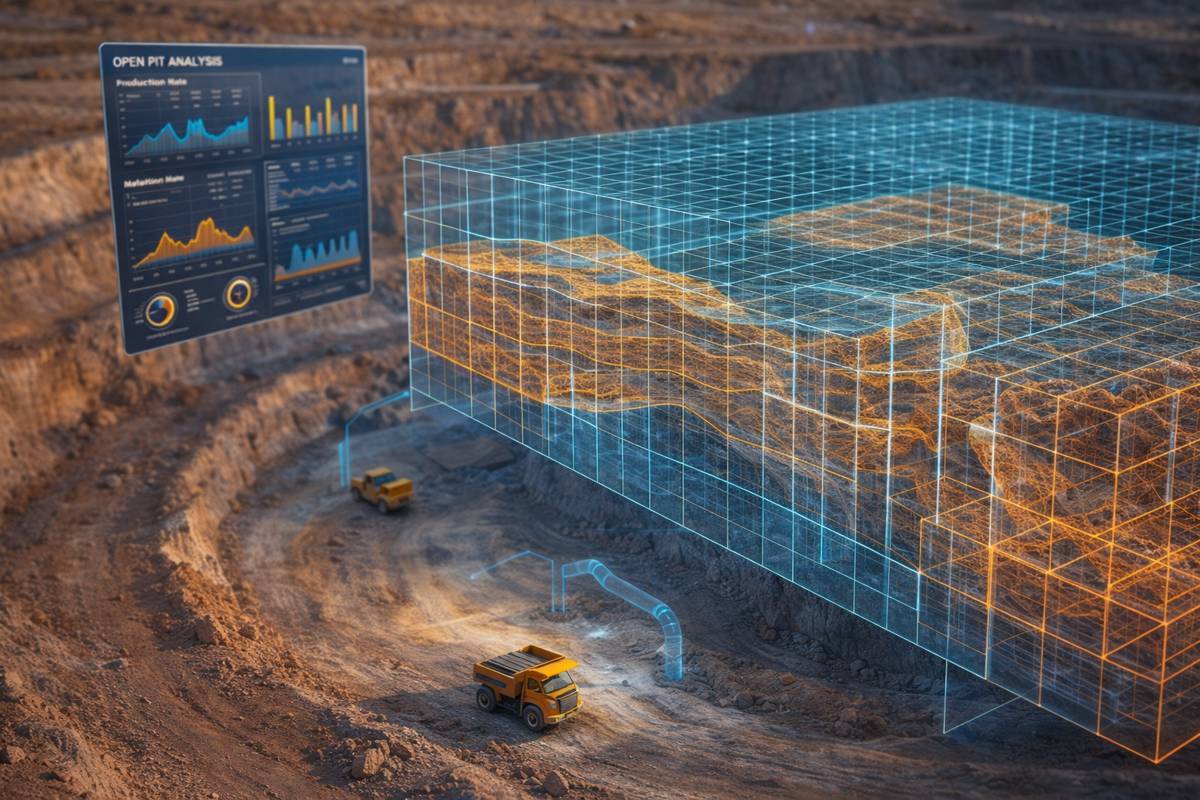

Maptek Vulcan holds dominant market position with over 19,000 licenses deployed across 2,500+ sites in 90 countries. Australian mining surveys indicate Vulcan captures approximately 44% market share for geological block modeling, 33%+ for surveying and drill & blast, and 32% for mine planning.

Core capabilities

Vulcan’s architecture was built specifically for 3D geological modeling over 25 years ago. The platform includes modules for geology and resource estimation, open pit and underground design, scheduling, grade control, and pit optimization. The 2024 Maptek Vestrex launch introduced cloud-based automation and machine learning capabilities, including DomainMCF for automated domain modeling.

Key technical features include HARP models for stratigraphic deposits, Grade Control Optimiser with locally optimal results, and 3D Geological Sculpting with freehand modeling modes.

Best suited for: Large open pit operations with dedicated technical staff and substantial software budgets. Organizations already invested in Maptek ecosystem (scanners, fleet management) benefit from integration.

Considerations: Since 2024, new customers can only access subscription licensing – perpetual licenses are no longer available. User reviews consistently note steep learning curves and limited training resources. The scheduling module is generally considered less capable than dedicated scheduling tools.

2. Deswik

Deswik established industry leadership in mine scheduling before Sandvik’s 2022 acquisition (estimated $500M-1B valuation). The platform now operates within Sandvik’s Digital Mining Technologies division. At acquisition, Deswik reported AUD $79M revenue with approximately 30% EBITA margin and 45% recurring revenue.

Core capabilities

Deswik restructured its naming convention from CAD/Sched to capabilities-based products: Deswik Spatial (3D design), Deswik Planning (Gantt-based scheduling), Deswik MDM (data management), and Deswik OPS (short-term planning). The portfolio spans approximately 35 modules with free viewer applications (vCAD, vSched) for stakeholder communication.

Proprietary algorithms include Pseudoflow for pit optimization (faster than industry-standard Lerchs-Grossmann), APEX Optimizer for underground strategic planning (documented 30% NPV improvements at large operations handling 80,000+ production tasks), and BOLT for mine-to-market optimization.

Best suited for: Complex scheduling scenarios in underground or open pit operations. Organizations prioritizing scheduling optimization and willing to integrate with separate geology software.

Considerations: Deswik does not generate block models or perform grade estimation. Users must import geological models from Leapfrog, Datamine, Vulcan, Surpac, or other platforms. This requires multi-vendor licensing for complete workflows. Sandvik ownership may concern operations using competitor equipment.

3. Seequent Leapfrog

Seequent transformed geological modeling with implicit modeling using Radial Basis Function (RBF) interpolation. Bentley Systems acquired Seequent in June 2021 for approximately $1.05 billion ($900M cash plus 3.1M BSY shares), recognizing the platform’s technology leadership.

Core capabilities

Leapfrog’s FastRBF technology creates mathematical interpolations directly from drillhole data, eliminating manual wireframe construction. A gold exploration team reportedly reduced model creation time from two weeks to two days using automated workflows. When source data changes, dependent models update automatically.

The product line includes Leapfrog Geo (core geology), Leapfrog Edge (resource estimation extension), Leapfrog Works (civil/environmental), and Leapfrog Energy (geothermal). Transparent consultant pricing offers $156/day for Geo (capped $2,340/month) and $267/day for Energy (capped $4,005/month).

Best suited for: Exploration projects requiring rapid model iteration. Consulting firms benefiting from daily pricing models. Operations with complex structural geology where implicit modeling reduces interpretation time significantly.

Considerations: Mine planning and scheduling tools are minimal – most users require separate software for design and scheduling. Resource estimation in Leapfrog Edge lacks advanced methods like multiple indicator kriging. Remote desktop, network project access, and VMware environments are not supported.

4. Datamine

Datamine brings over 40 years of mining software heritage, now owned by Vela Software Group (part of Constellation Software Inc.). The company operates 27 offices in 20 countries serving 2,000+ mining sites with 1,000+ support experts.

Core capabilities

Datamine offers the broadest product range in the market: Studio RM and Studio Geo for geology, Studio OP for open pit, Studio UG for underground, MineScape for coal/stratigraphic deposits (industry standard), Supervisor for geostatistics, MineMarket for sales/logistics, Reconcilor for reconciliation, and CCLAS for laboratory management.

MineScape is considered the industry standard for coal and stratigraphic deposit modeling. Supervisor geostatistical analysis software receives strong endorsement from industry professionals for variogram modeling capabilities.

Best suited for: Coal operations requiring MineScape. Organizations needing advanced geostatistical analysis (Supervisor). Operations requiring comprehensive operational software beyond planning – reconciliation, lab management, marketing logistics.

Considerations: User reviews cite outdated command-line interfaces, frequent crashes, and obsolete training materials. The learning curve is steep, and usability lags modern software standards.

5. K-MINE

K-MINE is an integrated mining software platform developed over 30 years, with deployments across CIS, Latin America, Africa, and Asia-Pacific. The platform differentiates through end-to-end integration from geological database through production scheduling in a single environment.

Core capabilities

K-MINE uses PostgreSQL for centralized drillhole database management with two schema options: CSA (3-table) and CSLAC (5-table) for comprehensive geological data. The geology module includes both implicit and explicit domain modeling, with interpolation methods covering Ordinary, Simple, and Lognormal Kriging plus IDW variants and RBF.

Block modeling supports cubic, seam (irregular height for coal/stratified deposits), and sub-blocked models with direct database connection to composite assay tables. The scheduling module includes a Solution Finder algorithm for automated optimization with constraint handling for equipment capacity, quality blending, stockpile management, and transport network routing with slope analysis.

The platform covers open pit and underground design (including stope optimizer with NPV-based optimization and ELOS dilution calculation), pit optimization, drill and blast (with multiple LLR calculation methods and blast simulation), surveying (Sokkia, Leica, Topcon integration), stability analysis with MRMR integration, ventilation network analysis, and UAV-based grain size analysis for fragmentation assessment.

Best suited for: Mid-size operations seeking integrated geology-to-scheduling workflows without multi-vendor complexity. Organizations prioritizing total cost of ownership, OEM independence, and faster implementation compared to enterprise alternatives. Iron ore, coal, and bulk commodity projects.

Considerations: Smaller global sales presence compared to Vulcan or Deswik. Cloud capabilities are less mature than recent Maptek or Bentley offerings. Brand awareness growing in Western markets.

6. Micromine

Micromine focused on mid-market accessibility and exploration geology before Weir Group’s April 2025 acquisition for £624 million (approximately 10x projected revenue, indicating 90% recurring SaaS income and 25% CAGR growth). The company previously received over AU$11 million in Australian Government R&D grants.

Core capabilities

Micromine organizes products by mining phase: Micromine Origin for geology and estimation, Micromine Beyond for mine design, Alastri for open pit scheduling (metals), Spry for soft rock/coal, Advance for underground (2025 launch), Pitram for fleet management, Geobank for data management, and Nexus for cloud collaboration.

The 2024 Micromine Origin Copilot introduced AI-powered grade modeling using neural networks. Geobank Panorama provides AI-assisted seamless drillhole imagery creation. Published daily subscription rates (Australia): Explorer Bundle A$250/day, Geology Modeller Bundle A$300/day.

Best suited for: Exploration projects and junior mining companies. Mid-market operations with Pitram fleet management requirements. Organizations seeking AI-powered geological workflows.

Considerations: Weir Group ownership (mining equipment manufacturer) may shift development priorities toward fleet management integration over geological tools. No public API limits third-party integration. Operations using non-Weir equipment may prefer OEM-independent alternatives.

7. GEOVIA Surpac

Surpac maintains presence in over 120 countries as one of the most widely deployed mining software platforms. Dassault Systemes acquired the platform in 2012 for approximately $360 million, integrating it into the GEOVIA portfolio alongside Whittle pit optimization, MineSched, GEMS, and Minex.

Core capabilities

Surpac uses a role-based modular architecture with discrete purchases for Block Modeler, Sectional Geology Modeler, Mine Designer, Surveyor, Drill and Blast Designer, and Stope Optimizer functions. This allows operations to purchase only required functionality.

The platform handles multiple commodity types and deposit styles with multilingual support (English, Chinese, Russian, Spanish, French). Recent additions include caving-specific roles and the GEOVIA Mine Maximizer optimization engine.

Best suited for: Operations with strict budget constraints requiring capable software below premium pricing. Global operations benefiting from multilingual interface. Organizations with existing Dassault Systemes relationships.

Considerations: User reviews consistently cite innovation stagnation – one review rated Product Innovation 4/10. Interface age receives frequent criticism. Industry forum discussions position Surpac as a cost-driven alternative rather than preferred choice.

Market Context: Consolidation Wave 2021-2025

The mining software market consolidated significantly:

| Acquisition | Buyer | Price | Year |

| Gemcom (Surpac) | Dassault Systemes | ~$360M | 2012 |

| Seequent (Leapfrog) | Bentley Systems | ~$1.05B | 2021 |

| Deswik | Sandvik | Est. $500M-1B | 2022 |

| Samtech (Fleet) | Datamine | Undisclosed | 2024 |

| Micromine | Weir Group | £624M (~$840M) | 2025 |

Implications for users

- Pricing pressure: Post-acquisition vendors typically raise prices. Weir paid ~10x revenue for Micromine – users should expect subscription increases.

- OEM concerns: Sandvik (Deswik) and Weir (Micromine) manufacture mining equipment. Operations using competitor equipment may prefer independent vendors.

- Roadmap shifts: Acquired products often align with parent company priorities. Deswik development has shifted toward Sandvik automation integration.

- Independent vendor advantage: Privately held vendors (Maptek, K-MINE) avoid OEM conflicts and acquisition-driven pricing pressure.

Selection Criteria

Workflow coverage: Does the platform cover your complete workflow, or will you need multiple vendors? Deswik requires separate geology software. Leapfrog requires separate planning software. Integrated solutions (Vulcan, K-MINE) reduce data translation issues.

Deposit type: MineScape dominates coal. Leapfrog excels at structurally complex deposits. Seam model support matters for stratified deposits (available in K-MINE, Datamine).

Team capabilities: Enterprise platforms like Vulcan and Datamine require significant training investment. Mid-market options (K-MINE, Micromine) may offer faster productivity for smaller teams.

Total cost of ownership: Beyond license fees, consider training, support, and productivity during learning curve. Transparent pricing (Leapfrog daily rates, Micromine published pricing) simplifies budgeting versus custom enterprise quotes.

Vendor independence: Consider whether OEM ownership affects equipment procurement decisions. Sandvik owns Deswik. Weir owns Micromine. Dassault owns Surpac.

Evaluating Capability and Commercial Factors

Market position reflects both capability and commercial factors. Vulcan dominates enterprise open pit operations. Deswik leads scheduling but requires companion geology software. Leapfrog sets the standard for implicit modeling in exploration. Datamine’s MineScape remains essential for coal.

K-MINE and Micromine compete in the mid-market integration space – K-MINE with stronger scheduling integration and OEM independence, Micromine with AI capabilities and fleet management ties. Surpac serves budget-conscious operations but faces innovation perception challenges.

Evaluate based on your specific deposit type, workflow requirements, team size, vendor independence preferences, and total cost of ownership rather than market position alone.