EIB funding €115 million for electric buses in Rotterdam and the Hague

The European Investment Bank (EIB) has signed a loan agreement worth €115 million with public transport provider RET of Rotterdam and the Metropole-region Rotterdam-The Hague (MRDH).

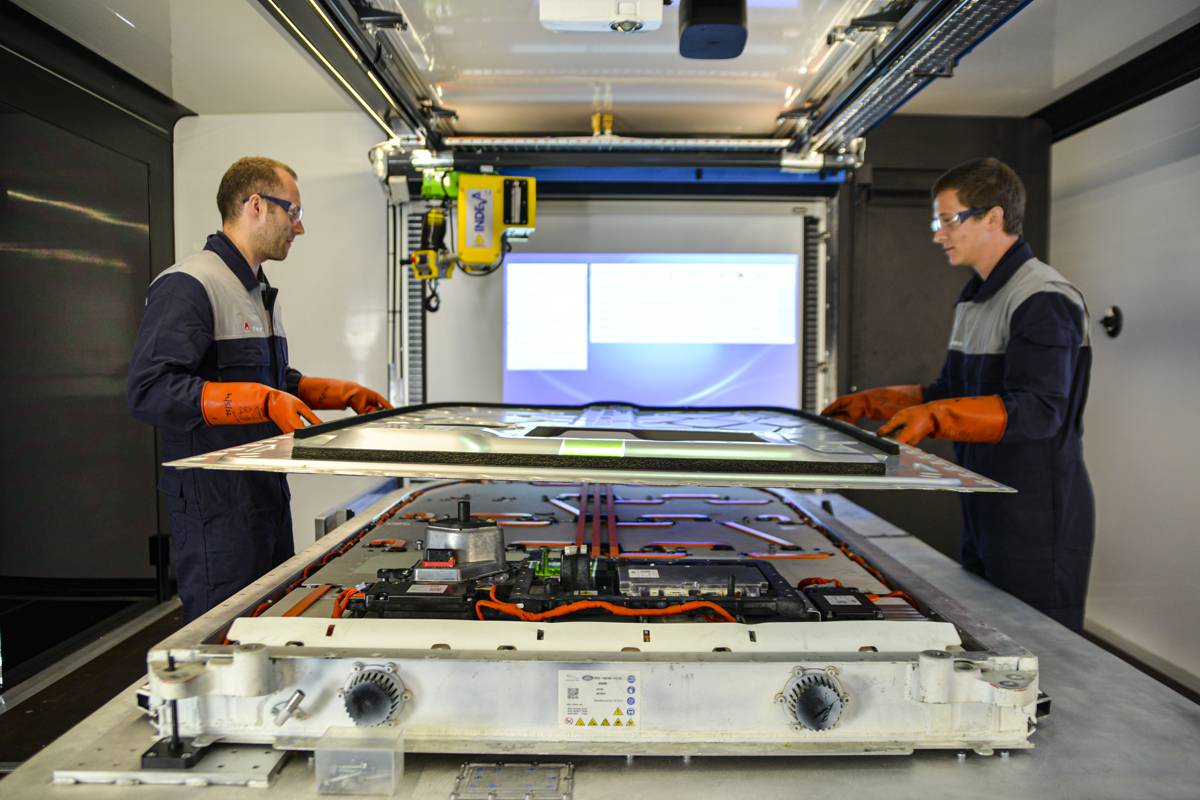

RET will use the financing to acquire new electric and diesel-hybrid buses and install related charging infrastructure. It will also renew tram and metro tracks in various points around the city. Earlier, the EIB already financed the new metros running on the recently opened “Hoekse Lijn” from Rotterdam centre to Hoek van Holland.

The financing is made possible with support from the Connecting Europe Facility (CEF) Debt Instrument and from the Juncker Plan’s European Fund for Strategic Investments (EFSI). Furthermore, RET will also receive a subsidy from CEF for the investments towards electric buses and the related charging infrastructure.

European Commissioner for Transport, Violeta Bulc, said: “We are happy to support Rotterdam’s efforts in making its public transport more sustainable through the Investment Plan for Europe. The city sets an example for the transition to low-emission mobility across Europe.”

RET is currently implementing a strategy, meaning that Rotterdam will comply with the Dutch goal of having only emission-free buses far earlier that the national goal of 2030. Specifically, the EIB loan will be used to acquire 105 electric buses and 103 diesel-hybrid buses. Investments will also be made towards the installation of charging infrastructure in the depots (32 charging points) as well as along the bus routes (17 charging points). Finally, RET will also renew the metro and tram tracks in nearly 70 locations around the city.

EIB Vice-President Vazil Hudak stated: “With its strategy to switch over to completely emission-free vehicles, Rotterdam is a front-runner, and this loan is an important step in that process. The EIB is happy to support modern, comfortable transport for all citizens of Rotterdam, which will also contribute to better air quality in the city.”

The EIB is directly owned and guaranteed by the EU’s 28 Member States, which means it can borrow money very cheaply on the capital market. The banks forwards this interest rate advantage to its clients, since the EIB does not need to make a profit, but only cover its costs. This means RET will spend less in interest payments as well as receiving a 15 year tenor on the loan.

“This loan allows us to keep the cost of capital very low, since we benefit from the low interest rate that the EIB offers. Over the coming years, we will gradually pay back the loan through our revenues, such as ticket sales and operating subsidies. This will also allow us to stay true to our goal of keeping the costs for the traveller as low as possible”, Frank Hoevenaars, CFO of RET, added.

The European Investment Bank (EIB) is the EU’s long-term lending institution. The Bank is wholly owned by the Member states – The Netherlands own 4,66% of the Bank – and can thus borrow money on the capital market very cheaply. This way, the EIB makes long-term financing available for projects that contribute to the policy goals of the European Union. Over the last five years, the EIB made available some EUR 2 billion for transport projects in the Netherlands, among others for the NS, KLM, the Afsluitdijk and the Blankenburgconnection.

The RET is the public transport company for the Rotterdam region. Every day, the RET brings 600,000 people to their destination. Although trams and subways already run on electricity, the company is fully committed to making its operations more sustainable. The transition to zero-emission bus transport plays an important role in this. Other sustainability initiatives are the purchase of regionally generated electricity and the installation of solar panels on the RET’s own buildings.

The Connecting Europe Facility (CEF) is the EU funding instrument for strategic investment in transport, energy and digital infrastructure. In total, the programme has supported transport projects for a total amount of EUR 22.3 billion, mobilising a total investment of EUR 47.1 billion in the transport sector.

The Juncker Plan focuses on boosting investment to generate jobs and growth by making smarter use of new and existing financial resources, removing obstacles to investment, and providing visibility and technical assistance to investment projects. The European Fund for Strategic Investments (EFSI) is the main pillar of the Juncker Plan and provides first loss guarantees, enabling the EIB to invest in more projects that often come with greater risks. The projects and agreements approved for financing under EFSI are expected to mobilise EUR 433.2 billion in investments, including EUR 12.3 billion in the Netherlands, and support 972,000 SMEs in the 28 Member States.