Sub-Saharan Africa construction growth faster than any world region over next five years

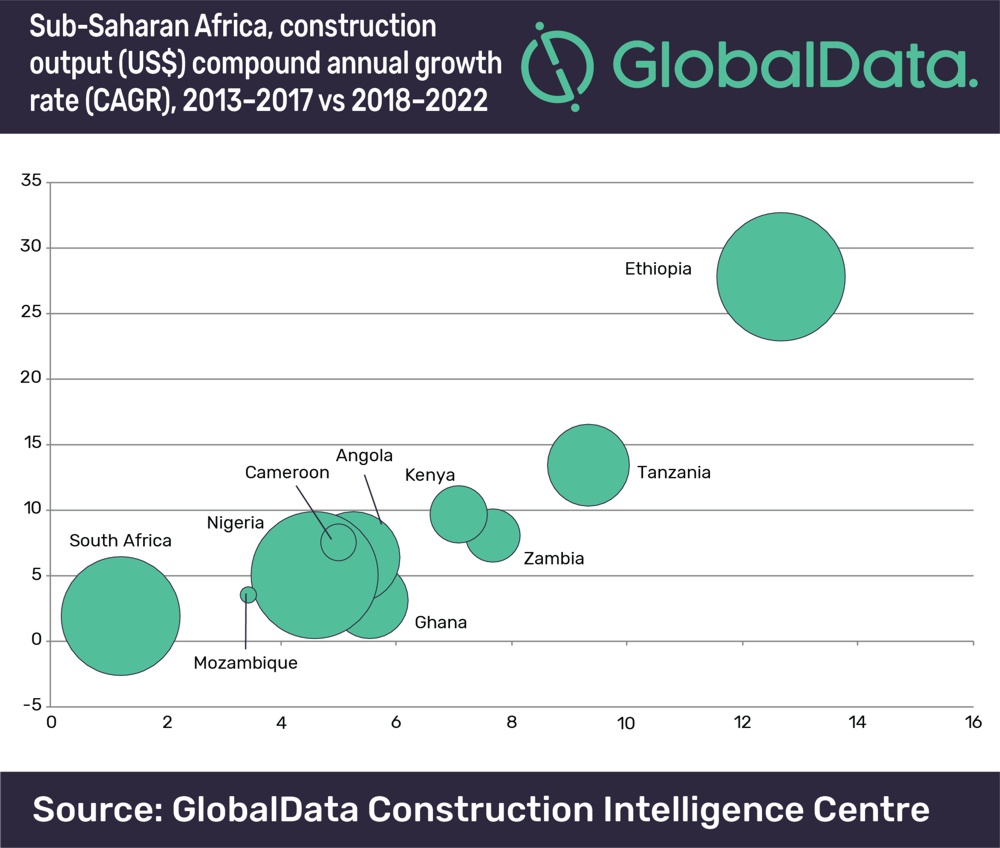

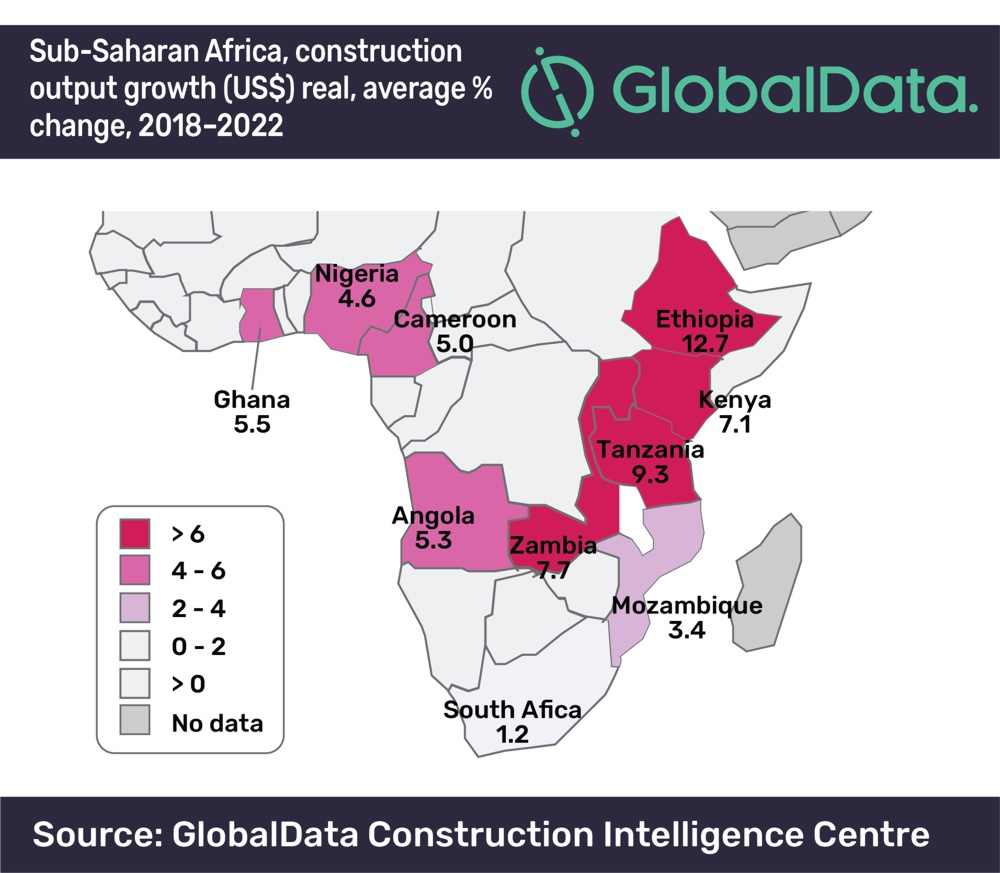

Sub-Saharan Africa will have the fastest growing construction industry among all major regions in the world over the next five, years growing on average by a compound annual growth rate (CAGR) by 6.6% a year, from 2018 to 2022, according to GlobalData, a leading data and analytics company.

The company’s latest report, ‘Global Construction Outlook to 2022: Q3 2018 Update’ also reveals that in real value terms, total global construction output is forecast to rise to US$12.9 trillion by 2022, up from US$10.8 trillion in 2017.

Regionally, Africa will become a major player in global construction over the next five years. There will be a steady acceleration in construction activity in Nigeria over the forecast period to 2022, supported by government efforts to revitalize the economy, by focusing on developing the country’s infrastructure. However, Ethiopia will be Africa’s star performer, where its construction industry will continue to grow in line with the country’s economic expansion.

Yasmine Ghozzi, Construction Analyst at GlobalData, comments: “The outlook for Tanzania remains positive, with construction growth anticipated to stand at over 9% in 2018–19. The fast pace of growth can be attributed to the construction of commercial and residential buildings, and on-going infrastructure construction projects, including the Standard Gauge Railway (SGR) and the expansion of Mwanza airport.’’

Kenya’s construction sector grew by 7.2% year on year in Q1 2018. The sector’s growth, albeit slower than that of Q4 2017, was driven by the ongoing public infrastructure projects, such as phase two of the Standard Gauge Railway (SGR) as well as the continued development of buildings.

GlobalData expects South Africa’s construction industry to remain weak as construction spending has suffered, due to negative investor sentiment and slow economic growth.

Ghozzi continues, “South Africa officially entered a technical recession in Q2 2018. However, the construction industry increased by 2.3% quarter on quarter, with non residential building and construction work recording positive growth, but not enough to lift the countries overall economic performance.’’