3 predictions for the Automotive Supply Chain

The arrival of a new year provides a chance to look back on the year that was, dust off the crystal ball, and make some predictions about what lies ahead. In case of the automotive space, big changes are ahead for Tier 1 auto suppliers and the OEMs they serve. 2023 is the year that the impact of EVs will really start to be felt, and this impact will manifest across the industry in several key ways.

Dave Opsahl, CEO of Actify, shared his thoughts:

Suppliers will become more choosy

“For some time, auto suppliers have been getting swamped by an ever-growing wave of programs they need to manage, thanks to the move towards electrification in the auto industry. According to Bank of America’s predictions, the number of new model introductions (programs) will increase by 50% over the next three years; RBS Securities calls for a 66% increase over that period.

“Whereas suppliers might once have needed to manage the design and development of components for a single internal combustion engine (ICE) vehicle, they might now need to manage three separate programs – one for the ICE platform, one for the hybrid version of that vehicle, and one for the electric version.

“That’s a lot of programs to manage – and not all of them are profitable, given the low volume that some of them come saddled with. (There’s a big difference between being contracted to make 600,000 parts for an ICE vehicle versus 6,000 parts for a hybrid vehicle).

“The result is that in 2023, suppliers will become much more selective about the opportunities that they pursue. Newly released data from Roland Berger Consulting shows that suppliers’ profit margins in North America have declined from a heady 9% in the 2010s, to approximately 3-3.5% in the current environment. With these razor-thin margins, suppliers have no choice but to be extra cautious about what business they choose to take on and which programs they agree to manage.”

Legislative moves will start changing the automotive supply chain

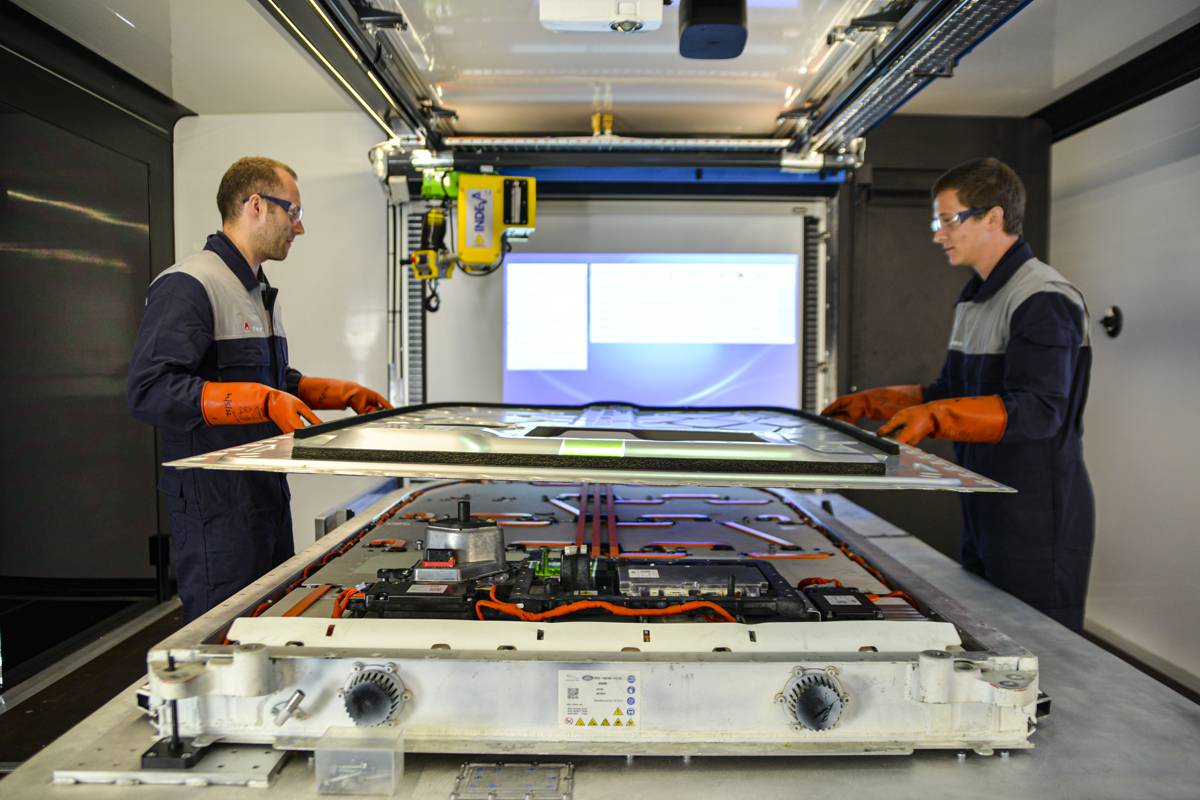

“In 2023, the entire automotive ecosystem is going to start feeling the impact of various pieces of legislation that passed in 2022 that in some way touch on EVs. The Inflation Reduction Act of 2022, for example, provides a $7500 tax credit for electric vehicles. Notably, however, this credit comes with several stipulations aimed at bringing EV battery production and EV vehicle assembly closer to home.

“This friendly nudge towards near-shoring by the U.S. government is already significantly rejiggering the automotive supply chain. Volkswagen, Mercedes, and Hyundai have been some of the first OEMs off the starting blocks, announcing new plants and sourcing arrangements in North America while tiptoeing away from the overseas labor arbitrage model that long dominated their operations. More OEMs can be expected to tread a similar path in 2023.

“Meanwhile, additional 2022 legislation is adding fuel to the EV push: California announced that by 2035, all vehicles sold in California will need to be zero-emissions vehicles.

“Will other states follow California’s lead? Given that 17 states already model their emissions laws on California’s, it’s safe to say that they will. That means that electrification will become even more of a priority for OEMs, keeping the pressure on suppliers in the year ahead to successfully deliver on ever-more programs.”

OEMs will finally understand the need for co-operation

“Every traditional OEM has dreams of becoming the next Tesla. But the sheer math of the situation doesn’t add up: The OEMs can’t all simultaneously make good on their ambitious plans to bring new models to market if they push the suppliers any harder than they already are. The supply chain will implode.

“At some point, the OEMs have to realize that their relationship with suppliers needs to be a partnership, not a cost reduction exercise. Otherwise, they might be pushing the supply chain too hard and effectively cutting off their noses to spite their faces.

“Of course, OEMs have long had a small subset of preferred suppliers that they work with very closely. But for every one of those suppliers, there are dozens of others who make the thousands of parts that go into the assembly that they treat in a highly transactional manner.

“In 2023, OEMs are going to have to get rid of this two-tier system and think more strategically about all of their suppliers, not just the preferred few. Consider 2023 the year that OEMs figure out that they need to work cooperatively with suppliers if they want the supply chain to hold in the EV era.”

Welcome to “Big EV”

“Some day, interested parties might look back and try to pinpoint the moment we tipped over from the “small EV” era, to the “Big EV” era – the point at which the impact of electrification went from minor to major and became impossible to ignore across multiple aspects of the industry.

“2023 is shaping up to be just that kind of year; the question is, is the industry ready for it? We’ll see as the year unfolds.”